As India commemorates its 79th Independence Day, a moment of profound gratitude and collective reflection on the nation’s remarkable journey, few narratives resonate as powerfully as the transformation of its dairy sector. We went from a country with very little milk to becoming the world leader in dairy. This wasn’t just about making more milk; it was a revolution that gave our farmers power, made rural areas richer, and brought prosperity to millions of families. It completely changed our agriculture and the lives of our people.

This monumental achievement is a testament not only to the strategic foresight of policymakers and the unwavering dedication of millions of farmers, but, crucially, to the inherent ‘mother power’ of our bovine population. Indeed, in this unparalleled success story, the steadfast contribution of our cows stands as a foundational pillar, elevating India to its preeminent position on the global dairy map.

On this auspicious day, I thought of taking you through the remarkable growth story of the Indian dairy sector, seen at an interval of 25 years each, starting from 1947.

Happy independence day !!

Indian dairying at the time of independence

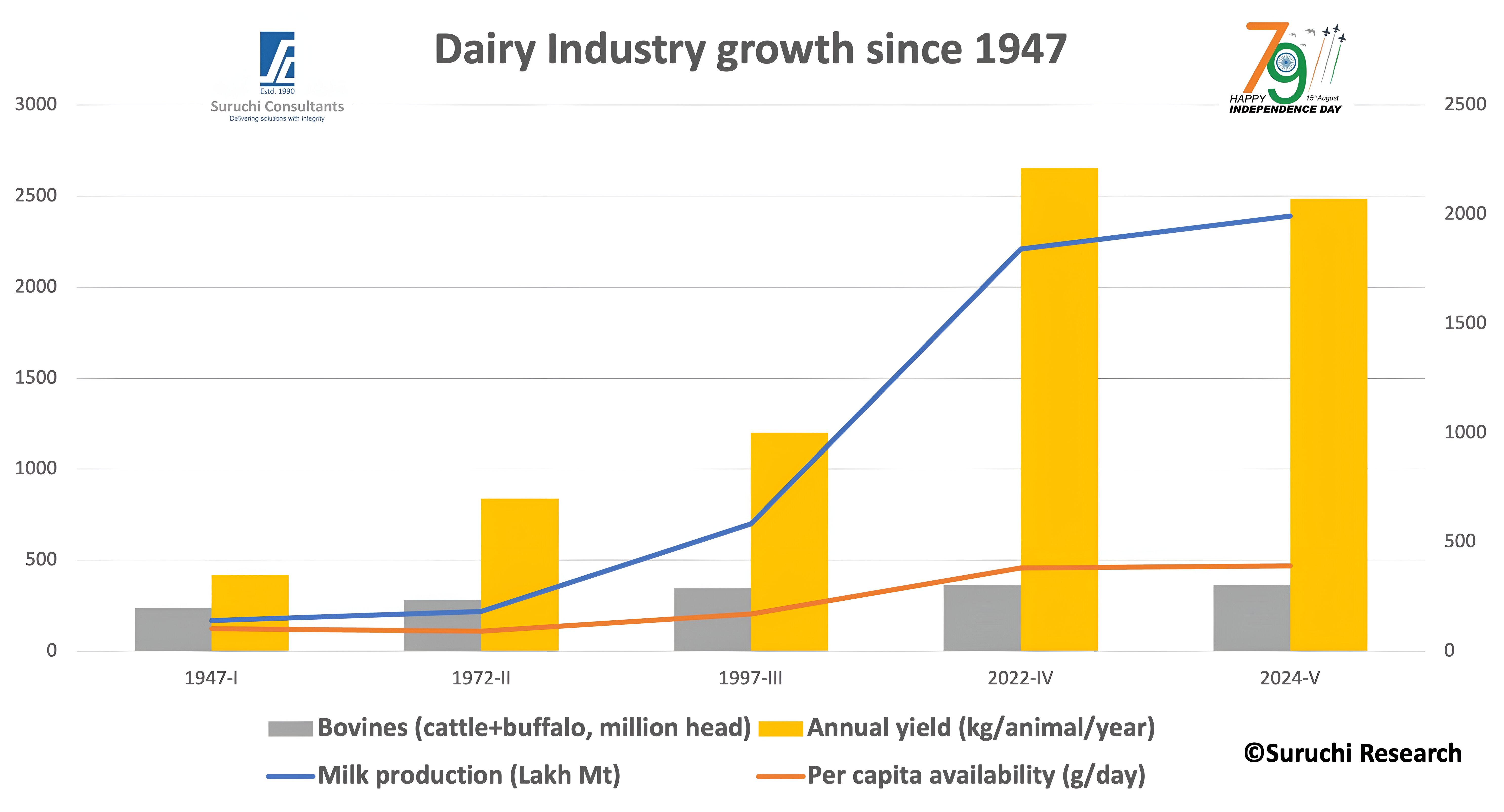

At independence in 1947, India’s dairy sector was rudimentary: human population hardly outnumbered cattle, but milk yields were tiny. The 1951 livestock census recorded about 155 million cattle and 43 million buffaloes, but annual milk output was only ≈17 million tonnes (Mt) – roughly 124 g of milk per person per day. Most milk was produced and consumed locally; there was virtually no processing industry or cold chain.

Dairy policy was unfocused, and farmers ran small indigenous (“desi”) herds, which gave only 1–2 litres per cow per day. A few local co‐operatives existed (e.g. the Kaira District Co‑op Milk Producers’ Union, later Amul), but most farmers sold milk informally. Feed and fodder were largely crop residues; an emerging livestock population already strained available feed. In short, 1947‐72 was an era of static growth: milk production hovered ~20 Mt, per capita availability even declined (to ~107 g/d by 1970), and the industry was overwhelmingly unorganized.

1972: Post-Growth War and Operation Flood I

By 1972 – the 25th year of Independence – India had launched its first push for dairy development. Cattle and buffalo numbers had grown: cattle rose to ~178.3 million and buffaloes to ~57.4 million (total bovine ≈235.7 m). Yet milk output was still low, roughly 21–22 Mt (coincident with the 1968–69 figure of 21.2 Mt). Productivity remained dismal (average yield <700 kg/lactation for desi cows).

In this period the government formed the National Dairy Development Board (NDDB) under Dr. V. Kurien and launched “Operation Flood I” (1970–1980). The strategy – the “Anand Pattern” – built village co‑op milk societies and procured milk at fair prices. During the 1970s the number of dairy coops rose sharply, notably in Gujarat and Punjab; farmers’ groups mobilized (10 million farm families by late 1970s). By 1972 urban milk supply began to improve, yet much milk was still sold raw or boiled at home. Fodder shortages were chronic (farmers depended on rainy-season grasses and crop leftovers), so the government began promoting fodder seeds and conservation. Parasitic diseases and occasional foot‐and‐mouth outbreaks also hampered the sector.

1980–1997: Expansion and White Revolution

By Independence Day 1997 (50 years), India’s dairy sector had transformed. Operation Flood had continued in two more phases (II: 1981–85, III: 1985–90), backed by NDDB and the co‑op movement. As a result, milk output exploded from ~20 Mt in 1970 to about 50 Mt by 1990–91, and reached roughly 69–72 Mt by 1997 (BAHS data shows 69.1 Mt in 1996–97; 72.1 Mt in 1997–98). Growth averaged ~4–5% annually through the 1980s and 90s. The cattle population also climbed (1997 census: ~198.9 m cattle, 89.9 m buffaloes; total ~288.8 m bovines). Per‑animal yields began rising with crossbreeding and better feeding. For example, by the early 1990s India’s improved crossbred cow yields (~6–7 kg/day) exceeded those of local breeds.

The cooperative movement thrived: most states formed milk unions and federations (e.g. GCMMF‑Amul), linking millions of smallholders. By 1997 organized dairies handled ~20% of milk (the rest still sold locally). The workforce, especially rural women, expanded in dairying – coops paid above-market prices, boosting incomes and village purchasing power. Processing capacity grew (modern plants, chilling centers, packaging). By the mid-1990s about 1,000 large co‑op and private dairy plants existed, often supported by village chilling units. Antibiotics began to be used for mastitis, and national FMD vaccination started, improving animal health.

1998–2022: Modernization and Record Production

In the 2000s and 2010s, India’s dairy sector continued rapid growth. Policies shifted toward liberalization and technology: private firms entered processing (Nestlé, Danone, others), and the government launched the National Dairy Plan (NDP) and Rashtriya Gokul Mission (RGM) in the 2010s. Genetics improved via massive AI programs and crossbreeding. The 2019 livestock census recorded ~125 million cows/buffaloes “in-milk”. Production soared from ~90 Mt in 2004–05 to 209.96 Mt by 2020–21, making India the world’s largest milk producer. NDDB reports milk output of 221.1 Mt in 2021–22 and 230.6 Mt in 2022–23, with per capita availability ~444–459 g/day in 2021–23. Many farmers now own improved breeds (e.g. HF crossbreds, Murrah buffalo) yielding >8–10 kg/day. Milk became a staple: by 2022 India produced about 24.7% of the world’s milk.

We tried to capture a few pivotal data points only from these quarterly periods starting from 1947 onwards. We have been quoting that India’s milk production is trebling and per capita milk availability doubling every 25 years since 1972. Believe me ,it is true till 2022.

Think next -India@2047

However will it continue this way or not from now onwards till India@2047 , is the question in my mind which I have tried to find answer through analysis here.

So I plotted this data to visualise the growth in lines and boxes. We plotted two charts only . The first one represented data related to production, lactation yield, per capita availability and cattle population. The second one got more granular with population growth of Cattle and buffalo. Lets begin with milk production growth and related elements.

The four curves we plotted — annual lactation yield, bovine population, milk production and per-capita availability — tell a single long story and several smaller, urgent ones. Taken together, they show how India moved from volume-by-headcount to volume-by-efficiency, and how that structural shift reshaped both national nutrition and the economics of the village dairy household.

In the first three decades after independence, milk availability rose mainly because there were more animals. That strategy masked a critical fragility: more animals meant greater dependence on scarce land and fodder, and it increased the exposure of smallholders to seasonal feed shocks. Operation Flood changed the game. By knitting millions of smallholders into co-operative milk collection, it created reliable demand. With assured procurement came farmer incentives to adopt cross-breeding, better feeding and basic health care — the first real productivity regime shift.

From the 1990s onward, and in a pronounced way after 2000, productivity became the dominant driver of output. One high-yield cow today produces as much milk in a season as several indigenous animals of the past. That structural intensification is visible in the data: bovine headcount stabilizes while production and per-capita availability climb steeply. For nutrition across India this is a resounding success — milk moved from luxury to routine, and average per-capita availability rose into the 400–470 g/day band.

But here is the inconvenient truth the curves hide unless you link them to farm incomes and the cost ledger: more milk does not automatically mean better incomes for every farmer. Profitability is the algebra of price minus cost. Yields inflated the numerator — only to have the denominator (feed, labour, vet costs) climb in many regions. Where cooperatives and processors provide steady daily procurement and transparent pay, farmers convert higher yields into reliable cash. Where markets remain informal, extra litres often depress spot prices and leave the farmer with marginal net gain — or none at all.

Policy Lapses- Opportunity lost

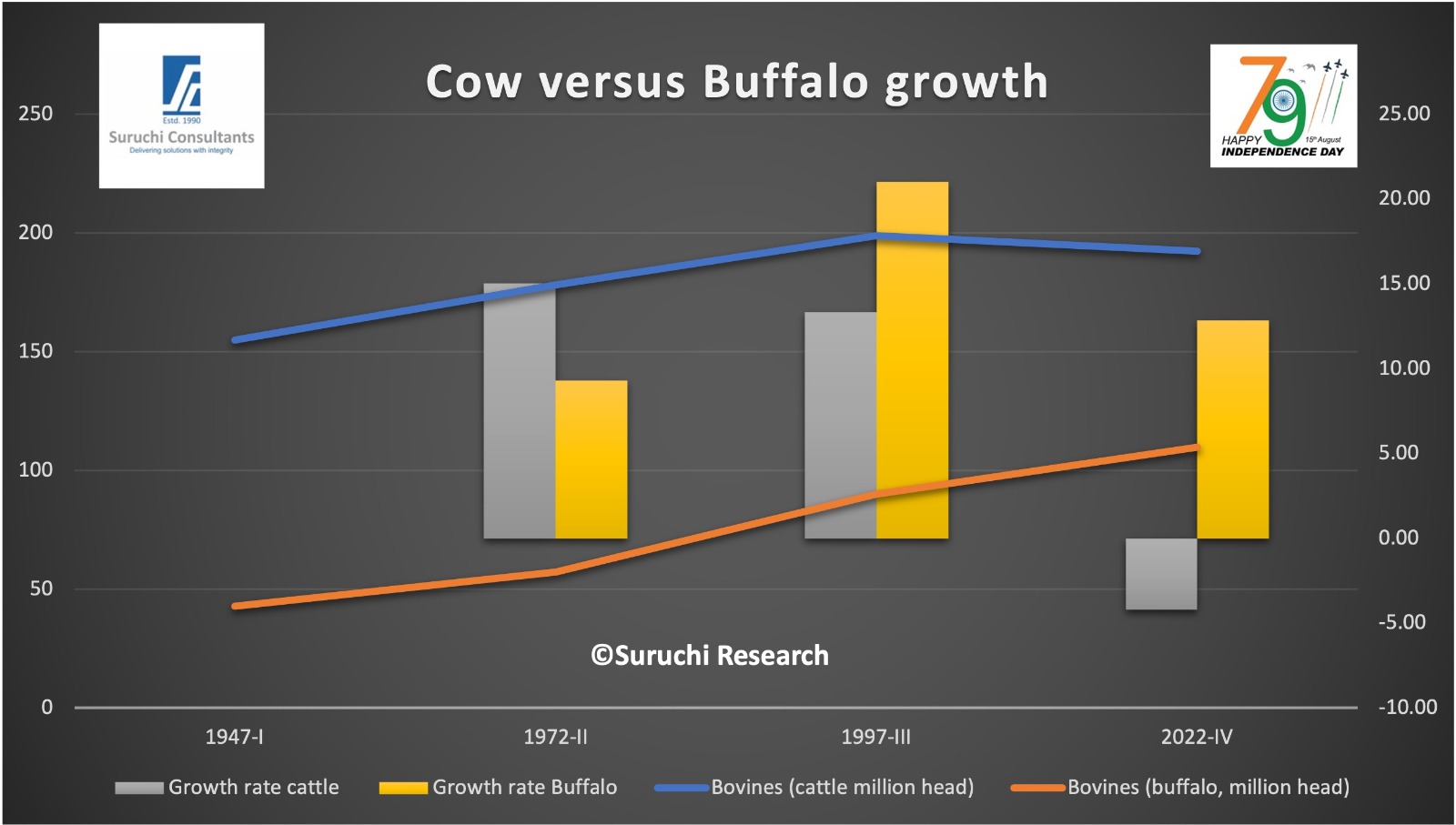

Before going further let us analyse the differential growth pattern of cattle population in India through the following curve. The curve clearly indicates very high growth in buffalo population than cattle since the independence time.

This differential growth had less to do with government support but more with farmer’s wisdom. Now we can clearly see a significant rise of buffalo population from 1947-2022 on the contrary, cow population showed a negative growth in the last quarter from 1997 to 2022. Buffalo has higher milk yield than cows also.

India has a uniqueness of having more than half of the buffalos in the world. Buffalo milk is known to be whiter and has high fat and total solid content. Higher total solids in buffalo milk reduces the carbon footprint in transporting equivalent quantities of cow milk on emission per kg of milk solids. Buffalos are climate resilient to Indian conditions and have better yield than desi cows also.

As per latest BAHS 2025 report India’s buffalo milk production has declined by around 16%. Now the results of latest ongoing Livestock survey will validate the decline in population claim if any. However huge traction in buffalo meat exports from India since last 2-3 years is indicating heavy diversion of buffalos for meat purpose. Culturally, buffaloes are often viewed differently from cows, and in some cases, farmers may part with unproductive animals to help sustain their livelihoods.

I am only left with a question on why the governments in past and the ones in present have ignored this black gold from India.

Policy Lapses- Income lost

Two disruptive policy effects deserve special notice. First, restrictions on cattle exit (slaughter and legal markets for unproductive animals) have closed a historic cash-out route for farmers. The consequence is obvious and cruel: farmers are often forced to carry non-productive animals indefinitely, pay recurring feed and vet costs, and in many places abandon animals — creating a stray-cow crisis that damages crops, causes accidents and degrades both welfare and rural security.

Second, while policy rightly promoted higher productivity (AI, sexed semen, IVF), it did not simultaneously deliver universal procurement coverage, price stabilization tools, or sufficiently deep fodder investments. In essence, we raised output capacity without guaranteeing market and feed economics that would lock gains into farmer bank accounts.

A second important insight: productivity yields are a non-linear lever. Small percentage gains invested in feed-efficiency and disease reduction produce outsized returns compared with the same percentage of herd expansion. This is exactly why current policy emphasis on AI, IVF and genetic improvement is sensible — but incomplete.

The bottleneck now shifts to feed economics, health management (mastitis control, vaccination, AMR mitigation), and organization of milk markets. Without these, productivity gains exacerbate structural dualism: well-connected, larger or co-op-member farms gain; marginal households fall behind.

Dairy exports can wait but not the farmer’s Sustainability

Let us also face the international dimension. India is the world’s largest milk producer yet remains a marginal dairy exporter. Domestic demand soaks up production, which makes Indian milk prices relatively insulated from global commodity swings — but it leaves export opportunity unexplored. A calibrated export push (focusing on value-added, quality-assured SMP, ghee and cheese) can be a buffer for seasonal gluts and a lever to improve farmer prices — provided quality, traceability and sanitary standards are met. However current geopolitics and tariff wars may not create the best of the situations for Indian dairy sector to explore exports in a big way. We should not forget that we hold over 16% population of the world and in dairy our total organised market is not even 40%. Volumewise as well as value wise our exports are hardly any percentage at both global and domestic levels. It is around 400 Mill USD against 108 Bill USD of global dairy trade and 800+ Bill USD of India’s total exports ( out of which Agri and processed food might be less than 10% of total exports).

So, Export push can wait. But efforts for sustainability may not.

Finally, the sustainability balance sheet is mixed. Dairy strengthens rural resilience and recycles nutrients through manure, but intensification without coordinated fodder and water policy increases local stress and contributes to GHGs. AMR is a latent risk: higher yields helped by antibiotics raise the spectre of residues and resistant bacteria unless withdrawal rules, surveillance and farmer training are enforced.

If independence is measured in capabilities, the dairy sector is among India’s most consequential successes: it solved scarcity and lifted the daily diet for hundreds of millions.

The way forward must convert production leadership into equitable income, resilience, and sustainability. That demands policy re-wiring: pair productivity with cost management, extend organized procurement, and restore humane, economically sensible options for managing non-productive stock. Only by aligning farm economics with product standards and environmental goals will India’s dairy revolution deliver its final promise — not just more milk, but better livelihoods for every household that depends on it.

By acknowledging these gaps while celebrating India’s remarkable dairy achievements, you not only honour the sector’s pioneers like Dr Verghese Kurien but call for policies that support sustainability, dignity, and inclusivity.

Source : Dairynews7x7 Aug 15th , Independence day special blog by Kuldeep Sharma Chief Editor Dairynews7x7