Farmers say cattle feed prices doubled in five years, but milk by only Tk10 per litre.

Dairy farmer Abdur Razzak from Shahjadpur in Sirajganj has not seen a rise in his income for over a year although his farm operating costs have significantly increased.

“Despite facing increasing costs for cow feed, farm staff, and electricity bills, I still sell milk to companies like BRAC and PRAN at the same rate of Tk45-49 as I did a year ago,” says disgruntled Razzak.

He notes that the price of milk at the farm level has not seen a proportional increase despite the challenges and rising costs, leading some farmers to consider reducing their involvement in milk production or downsizing their livestock.

Similar experiences are shared by other farmers in Sirajganj and Pabna. They claim that the big milk-buying companies are hesitant to raise milk prices for them. Instead, these companies are increasing the prices of processed milk and related products.

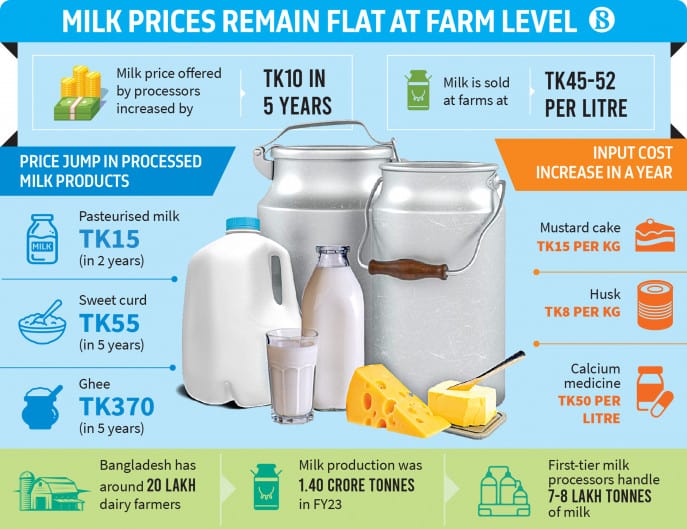

Prices of pasteurised milk per litre have increased from Tk70 to Tk90-95 in two years – once in the middle of 2022 by Tk10 per litre, farmers say.

Half a litre of sweet curd now costs Tk120, which was Tk80 in 2021. In 2018, a 900gm can of clarified butter (ghee) was at Tk1,020-1,050; the price has now surged to Tk1,420. Various other dairy products – sweets, ice cream, butter, and flavoured milk – are all being sold at higher prices.

Companies buy milk from farmers depending on the fat content. Milk produced by farmers can contain up to 3.5-7% fat. Most of these milks contain 4.0-5.0% fat.

“As the price of cow feed has increased, it has become difficult for farmers to survive by selling milk to the company,” he says.

Rising husbandry costs

Farmers say that in just one year, the price of cow feed and medicine has increased significantly. Among them, the price of mustard cake increased from Tk37-38 to Tk50-53, and husk from Tk40-41 to Tk48-49. Regular medicines like calcium (which farmers have to buy almost every month) have increased from Tk140-150 to Tk200 per litre.

Khokon Biswas, a farmer in Pabna’s Bhangura, tells The Business Standard, “I sell about 600 litres of milk daily to the company at Tk45 per litre. This price remains unchanged for two years. Prices, increased two to three times a year, are often reduced within 7-15 days.”

He mentions the rising cost of husk, now at Tk2,300-2,320 for a 43kg bag (previously Tk1,650), and a Tk200 increase for a 37kg bag.

Farmers note that despite cattle feed prices doubling in the last five years, the price of milk has only increased by Tk10 per litre, with zero growth in the last two years.

Shahid Ali, president of the milk producers’ association in Shahjadpur, says that currently, morning milk is priced at Tk43 per litre, and afternoon milk is priced at Tk49-50 due to higher fat content. He contrasts this with prices five years ago when morning milk was Tk36 per litre, and afternoon milk was Tk41.

Shahjadpur in Sirajganj has around 30,000 dairy farmers producing 5 lakh litres of milk daily. Combining big and small milk processing companies, they collect 3.5 lakh litres daily. Key companies include Milkvita, Arang, Pran, Igloo, and Akiz operating in Shahjadpur, Shahid mentions.

According to the livestock department, Bangladesh has around 20 lakh dairy farmers, with a milk production of 1.40 crore tonnes in 2022-23. First-tier milk processing companies handle 7-8 lakh tonnes of milk, producing processed milk and milk products.

The remaining milk is sold in sweet shops and open markets, with prices varying between Tk60-75, farmers say. Due to fluctuation in demand, they often struggle to sell in the open market, leaving them dependent on processor companies.

Md Emdadul Haque Talukder, director general of the Department of Livestock Services, told TBS, “Now we are asking farmers to increase the use of grass as feed. For this reason, grass cultivation is increasing all over the country. And those who depend on grass are in profit.”

He further mentions the ongoing initiative, the “Livestock and Dairy Development Project,” which aims to establish milk collection centres and processing zones nationwide.

This effort aims to reduce the monopoly of companies, providing better prices to farmers and modernising the entire supply chain, he adds.