The run-up in milk prices is expected to continue in fiscal 2024, led by buoyant demand, constrained supply and under-recovery of costs in the previous two fiscals. Demand has rebounded since the easing of COVID-19-induced restrictions on social gatherings and the hotel, restaurant and café segment, and is being fed by rising consumption of value-added products in tune with higher disposable incomes and changing lifestyles.

Supply, however, has lagged due to constrained production resulting from inclement weather conditions. Underfed cattle due to higher fodder prices, and cattle health not being in the best condition due to unseasonal rainfall and heatwave conditions have lowered milk productivity.

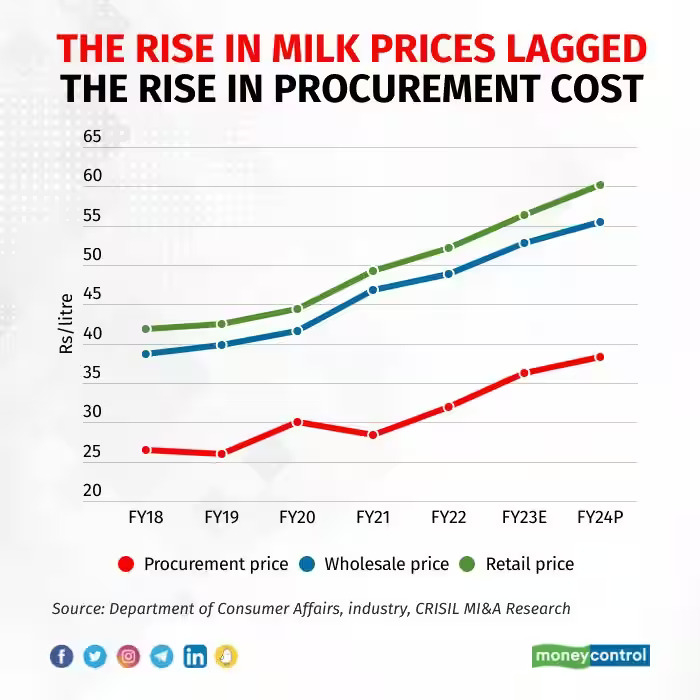

This has resulted in a spurt in milk procurement prices, of 12 percent last fiscal and an expected 14 percent in the current one. However, players have not been able to completely pass on the increase in milk procurement prices, which account for nearly 60-70 percent of milk retail prices, considering the increase in retail prices was 6 percent and 8 percent, respectively, during fiscals 2022 and 2023. The sharp contraction in the profit margins of dairy processors last fiscal and in the current one bears this out.

Thus, we expect players to sharply increase retail prices by 7 percent in the next fiscal to make room for margin improvement.

Fodder Gets Dearer

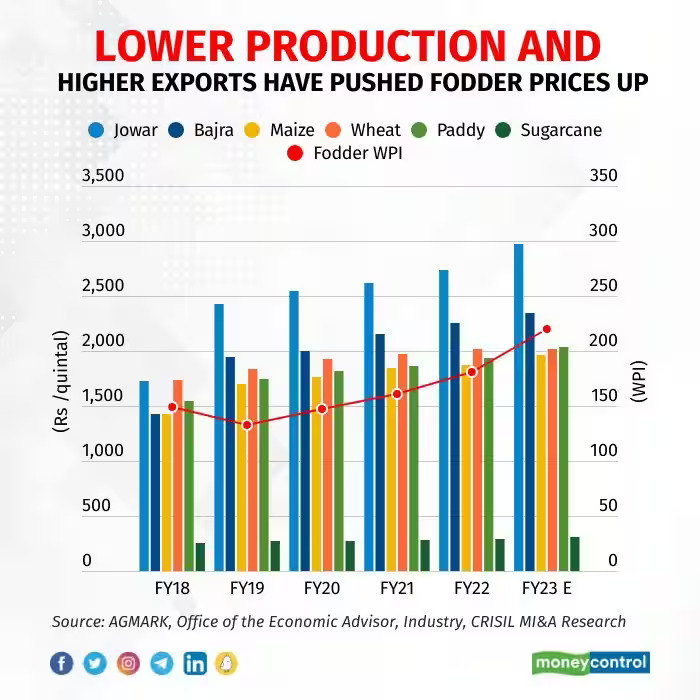

To be sure, the prices of most agri-crops have soared because of the Russia-Ukraine war and lower production yields caused by unfavourable weather conditions including severe heatwaves and an uneven spread of southwest monsoon during June-September 2022.

Among fodder crops, wheat, maize and jowar saw prices rise 19 percent, 20 percent and 15 percent on-year, respectively, this fiscal. The wholesale price index for fodder has also jumped from 180 to 220. The upshot is an increase in cattle-rearing cost, of which fodder accounts for 70-75 percent.

Most Indian dairy farmers are small or marginal and cannot afford fodder at such high prices. This has led to underfeeding of their cattle and, consequently, a fall in milk yield as also fat and solids-not-fat content of milk. Green fodder availability was affected by insufficient rainfall in June 2022 and unseasonal rainfall in September-October 2022 which damaged crops. Excess unseasonal rainfall in the current quarter has damaged rabi crops, and this is set to decrease fodder availability for the coming months.

That apart, a rise in COVID-19 cases during April-June 2020 and 2021 had reduced the demand for artificial insemination services. This led to a lower number of calf births during the period. Given that calves typically take 2.5 years to be ready for insemination, there was a shortage of animals available for insemination in this fiscal. A breakout of lumpy skin disease in certain high milk-producing pockets also led to a decline in milk production during the second quarter of this fiscal.

Demand for value-added products

The milk industry logged a price-driven growth of ~10 percent on-year in value terms this fiscal as milk is a deeply penetrated product with limited volume growth. Meanwhile, value-added dairy products recorded a volume-driven growth of ~18 percent, with demand increased due to rising disposable incomes and changing lifestyles. However, the milk supply is unable to catch up with the surge in demand for value-added products. We saw that during the festive season in the third quarter of this fiscal, a jump in demand for high-fat value-added dairy products caused a shortage of ghee and butter. As the festive season came to an end in the fourth quarter, the rise in demand for ghee and butter faded.

We expect the milk industry to grow by 8 percent in the next fiscal and value-added dairy products by ~15 percent.

Weather-related Risks

The expected El Niño drought conditions in the next fiscal could harm cattle health and reduce milk production. The drought could also lower kharif crop production and lower fodder availability, and thus impact milk production and its quality in the second half next fiscal. With the demand for dairy products increasing, milk prices could remain high.

If El Niño drought conditions do not materialise next fiscal, a bountiful kharif crop production and favourable weather will ensure cattle are fed appropriately. This, in turn, would increase milk production, halting the sharp increase in milk prices after two consecutive fiscals.

Raising Output

At the 49th Dairy Industry Conference organised by the Indian Dairy Association in March, the government set an ambitious target to raise India’s share in global milk output to ~33 percent, from 23 percent last fiscal, and increase dairy exports five-fold by fiscal 2034. For this, it proposed a second white revolution by setting up two lakh new dairy cooperatives.

The Indian dairy industry needs further enhancements across its value chain to achieve this target. On the input front, the foremost priority should be improving cattle health by eradicating foot-and-mouth disease and lumpy skin disease. Additionally, artificial insemination services should be ramped up extensively.

On the processing and storage side, investments should be made in high-quality machinery, particularly for value-added dairy products that command higher realisations. A robust cold-chain infrastructure would help smoothen distribution and extend the shelf life of dairy products. For holistic growth of the dairy industry, the government must also provide support to private players, who procure about half of the marketable surplus.

Pushan Sharma is Director, CRISIL MI&A Research. Views are personal, and do not represent the stand of this publication.