Highlights from the updated report include:

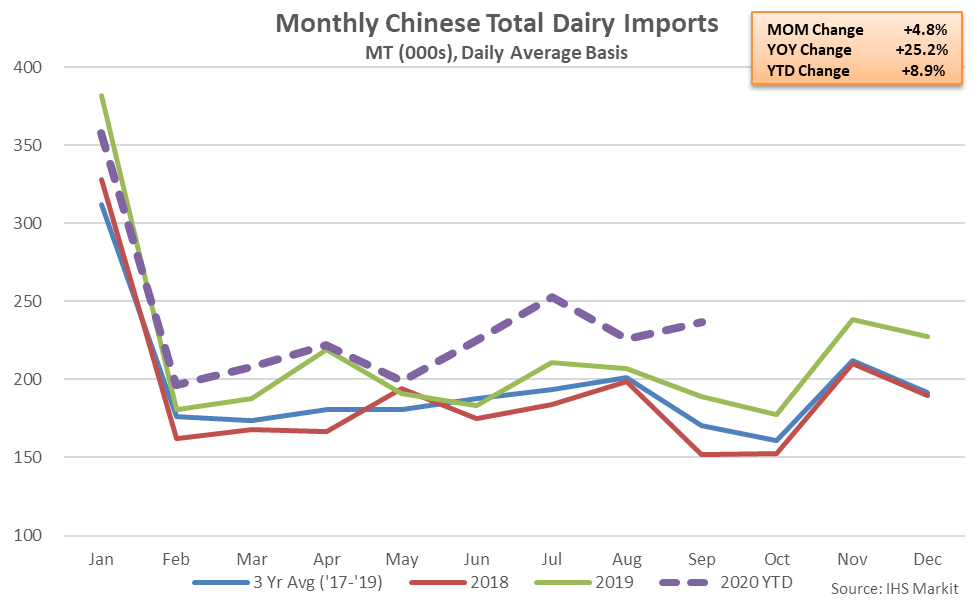

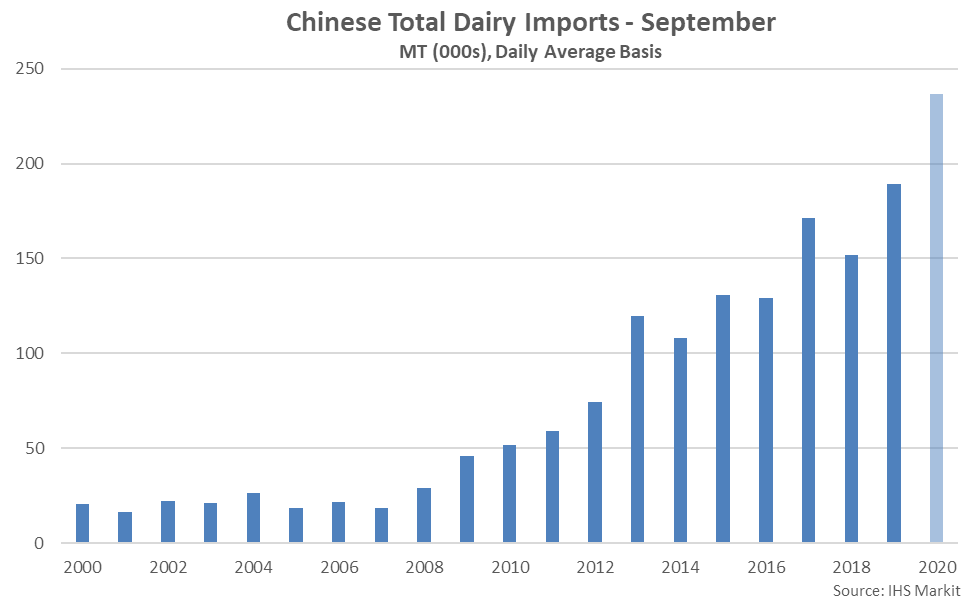

- Chinese dairy import volumes increased on a YOY basis for the 22nd time in the past 24 months during Sep ’20, finishing up 25.2% and reaching a record high seasonal level.

- Chinese whole milk powder import volumes increased to a seven year high seasonal level during Sep ’20 while Chinese skim milk powder import volumes reached a record high seasonal level. Chinese dairy imports excluding SMP and WMP remained at a record high seasonal level for the fourth consecutive month.

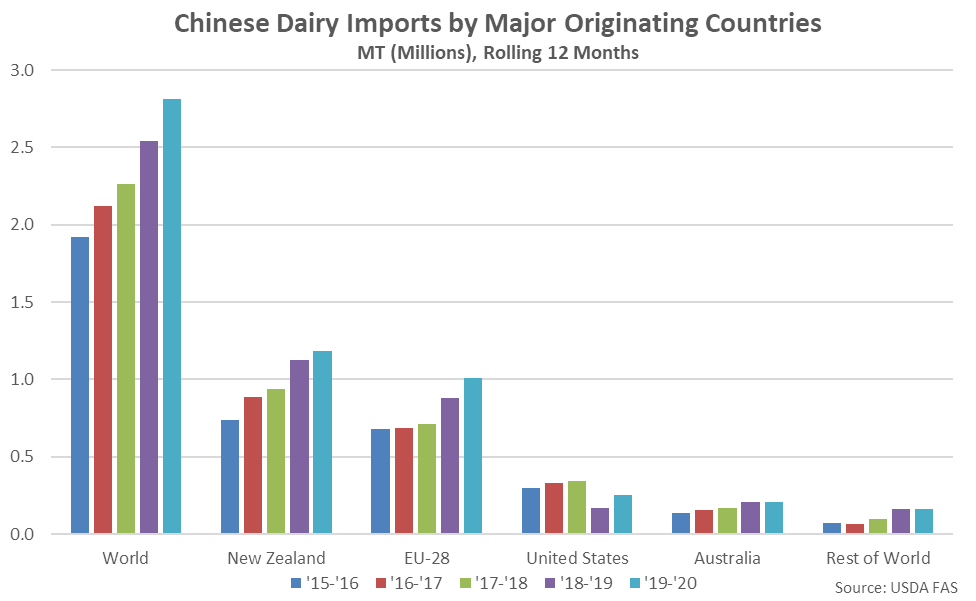

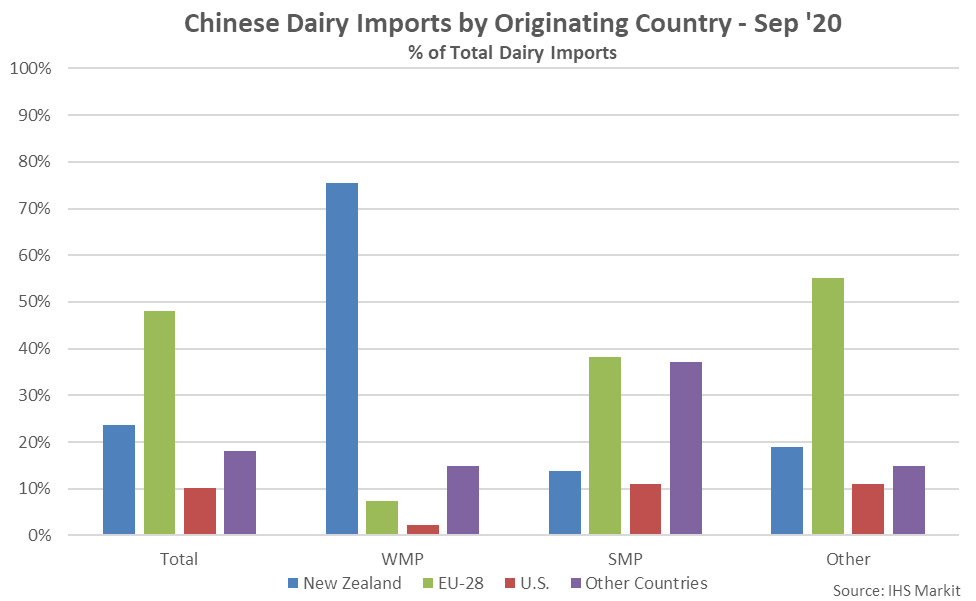

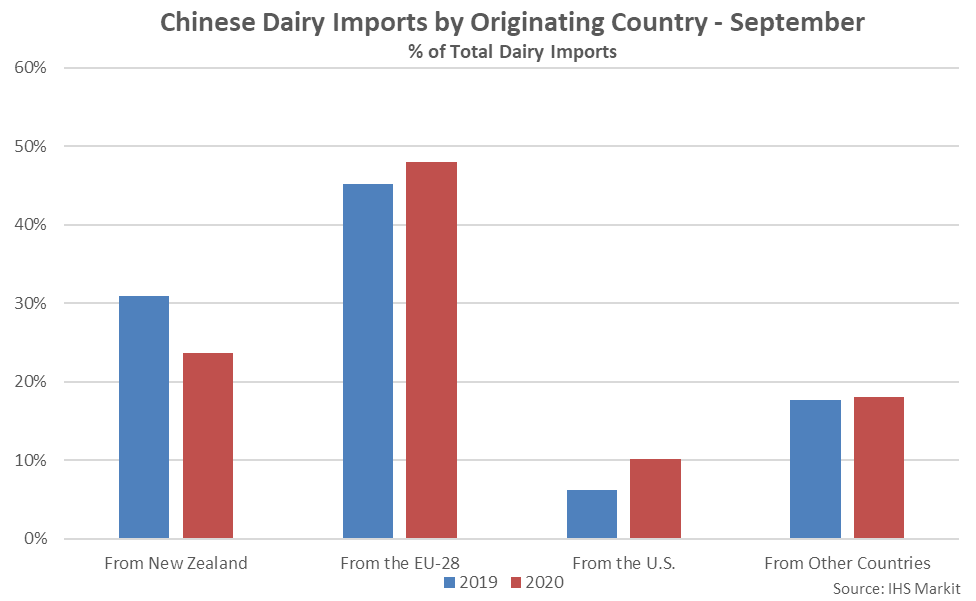

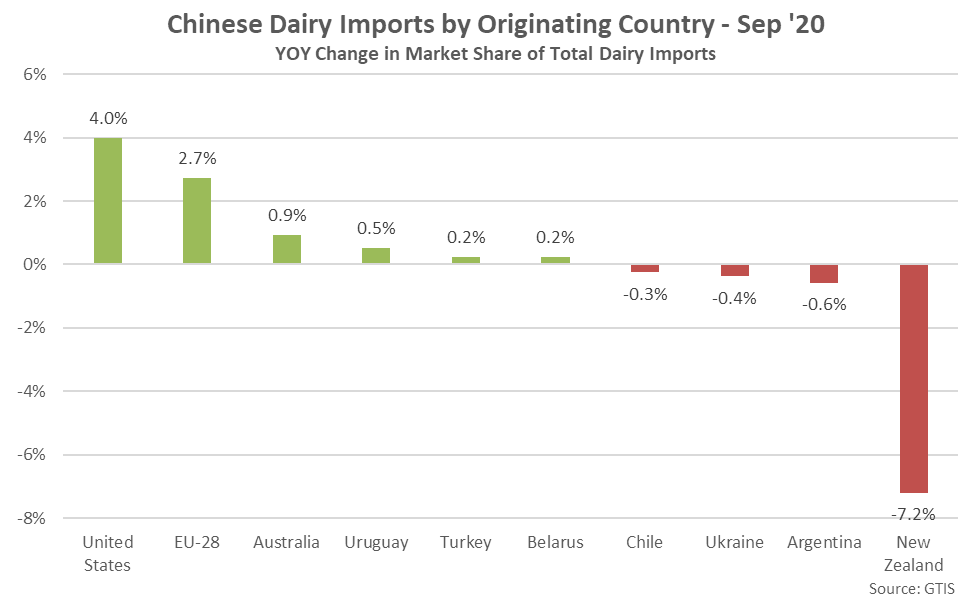

- The market share of Chinese dairy imports originating from within the United States increased most significantly from the previous year throughout Sep ’20, while the market share of Chinese dairy imports originating from within New Zealand finished most significantly below previous year levels.

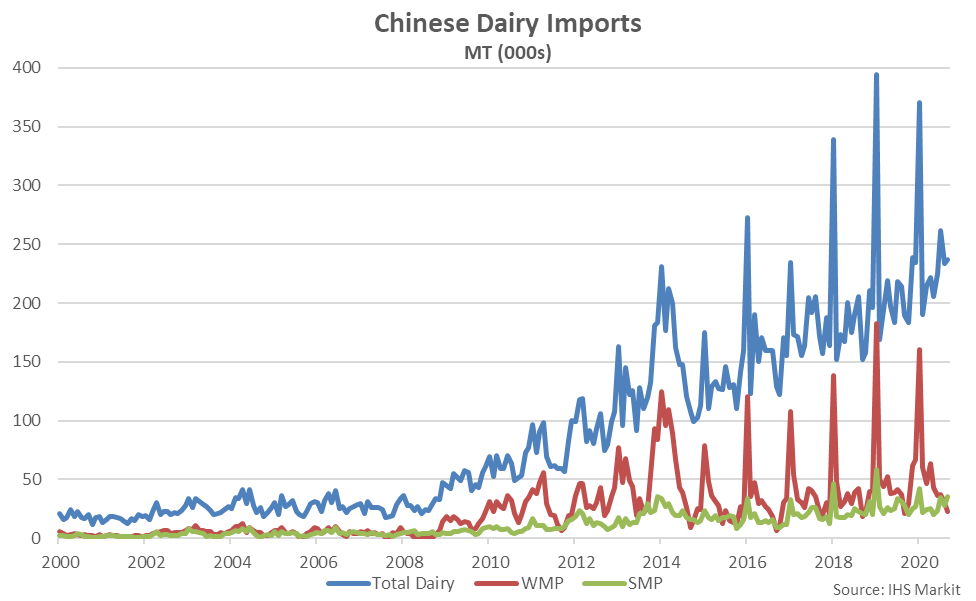

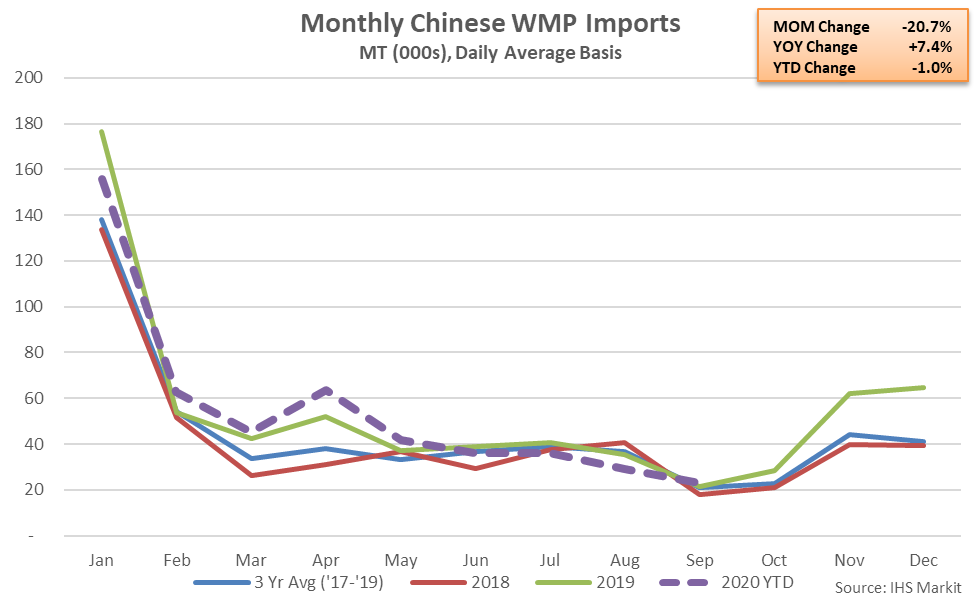

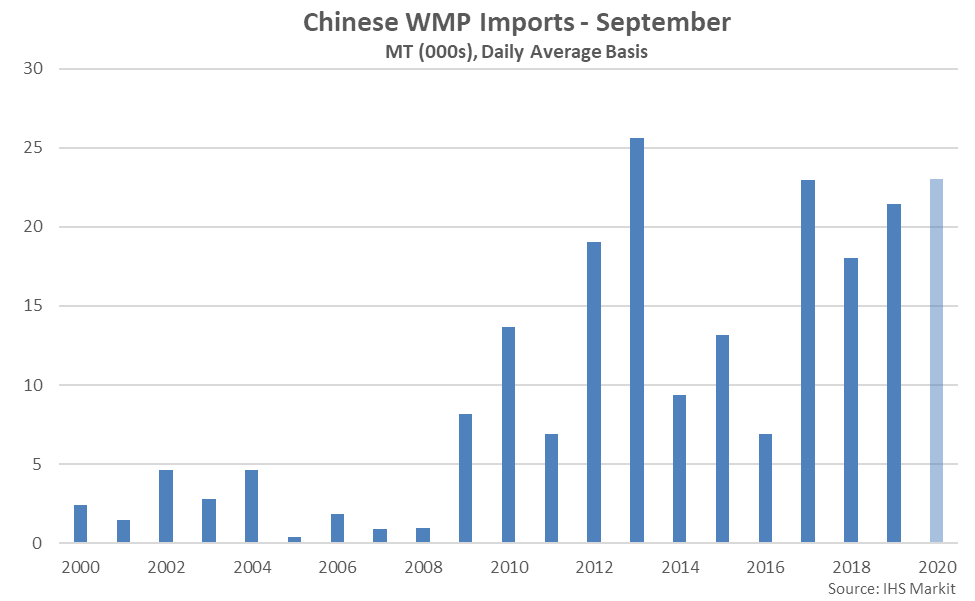

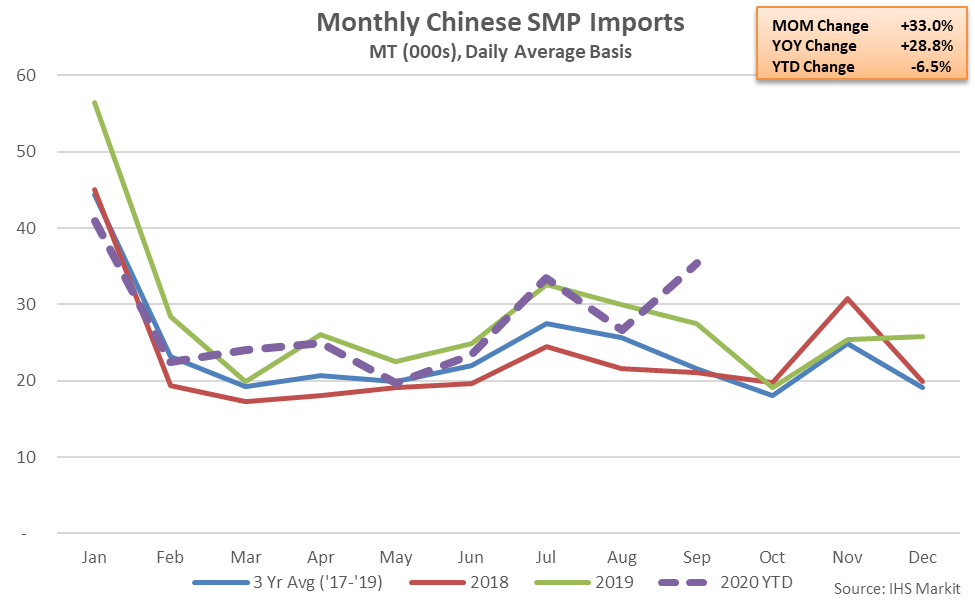

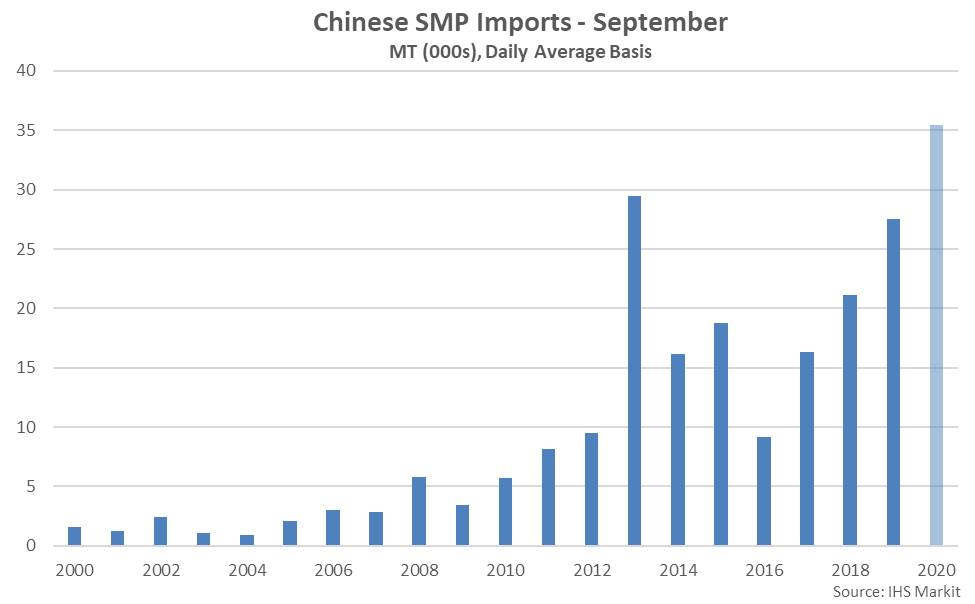

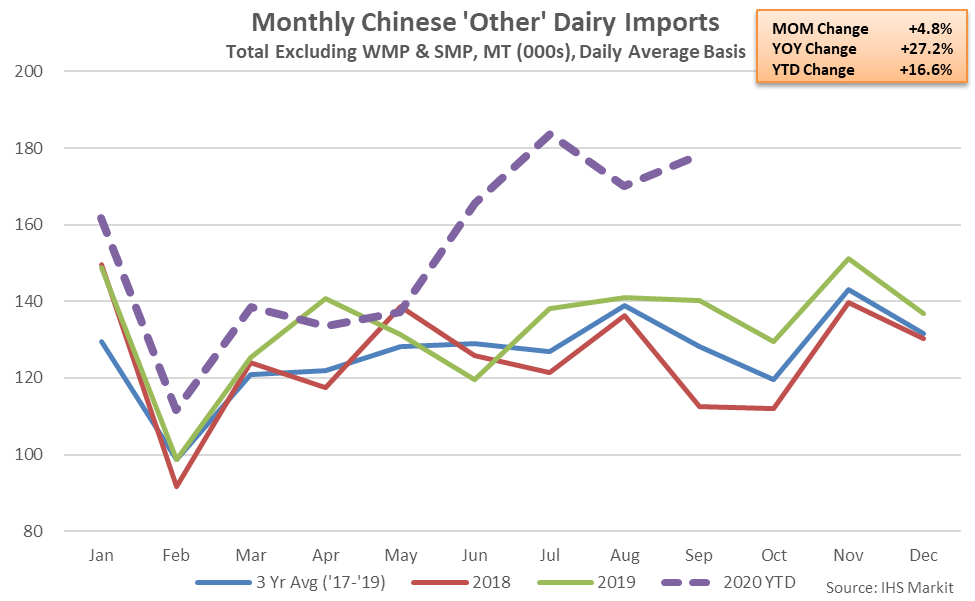

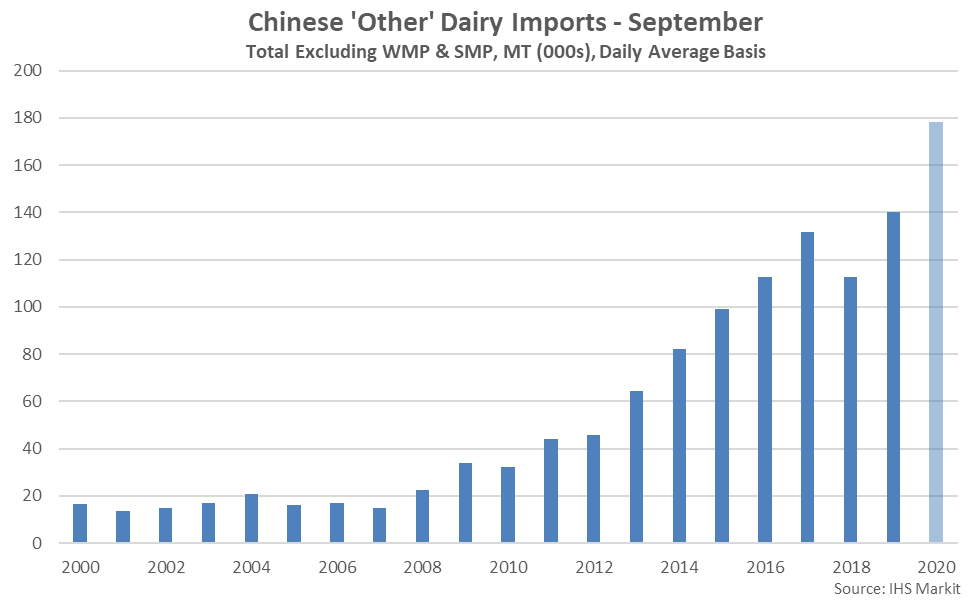

Additional Report Details According to IHS Markit, Sep ’20 total Chinese dairy import volumes remained higher on a YOY basis for the 22nd time in the past 24 months, finishing up 25.2% and reaching a record high seasonal level for the month of September. The YOY increase in Chinese dairy import volumes was the largest experienced throughout the past 17 months on a percentage basis. 2019 annual Chinese dairy import volumes increased 13.7% on a YOY basis, reaching a record high level, while 2020 YTD import volumes have increased by an additional 8.9% throughout the first three quarters of the calendar year. Chinese whole milk powder (WMP) import volumes increased 7.4% on a YOY basis throughout Sep ’20, reaching a seven year seasonal high level, while Chinese skim milk powder (SMP) import volumes increased 28.8% YOY, reaching a record high seasonal level. Chinese dairy imports excluding SMP and WMP increased 27.2% YOY, also reaching a record high seasonal level. The YOY increase in Chinese dairy imports excluding SMP and WMP was the 14th experienced throughout the past 15 months. Chinese dairy imports excluding SMP and WMP have reached a record high seasonal level over four consecutive months through Sep ’20. The market share of Chinese dairy import volumes originating from within the United States increased most significantly on a YOY basis throughout the month of September, while the market share of imports originating from within New Zealand finished most significantly below previous year levels. The U.S. market share of Chinese dairy import volumes increased to 10.2%, up from the 6.2% market share experienced during September of 2019. The U.S. market share of Chinese dairy import volumes has increased on a YOY basis over 11 consecutive months through Sep ’20. Sep ’20 Total Chinese Dairy Imports Rebounded Slightly From the Previous Month  Sep ’20 Chinese Dairy Import Volumes Increased 4.8% MOM and 25.2% YOY

Sep ’20 Chinese Dairy Import Volumes Increased 4.8% MOM and 25.2% YOY  Sep ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Sep ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level  Sep ’20 Chinese WMP Import Volumes Declined 20.7% MOM but Remained up 7.4% YOY

Sep ’20 Chinese WMP Import Volumes Declined 20.7% MOM but Remained up 7.4% YOY  Sep ’20 Chinese WMP Import Volumes Reached a Seven Year Seasonal High Level

Sep ’20 Chinese WMP Import Volumes Reached a Seven Year Seasonal High Level  Sep ’20 Chinese SMP Import Volumes Increased 33.0% MOM and 28.8% YOY

Sep ’20 Chinese SMP Import Volumes Increased 33.0% MOM and 28.8% YOY  Sep ’20 Chinese SMP Imports Reached a Record High Seasonal Level

Sep ’20 Chinese SMP Imports Reached a Record High Seasonal Level  Sep ’20 Chinese Dairy Imports Excluding WMP & SMP Increased 4.8% MOM and 27.2% YOY

Sep ’20 Chinese Dairy Imports Excluding WMP & SMP Increased 4.8% MOM and 27.2% YOY  Sep ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Sep ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level  The EU-28 Accounted for Nearly Half of All Sep ’20 Chinese Dairy Import Volumes

The EU-28 Accounted for Nearly Half of All Sep ’20 Chinese Dairy Import Volumes  The Sep ’20 New Zealand Share of Chinese Dairy Imports Finished Significantly Lower YOY

The Sep ’20 New Zealand Share of Chinese Dairy Imports Finished Significantly Lower YOY  The Sep ’20 U.S. Share of Total Chinese Dairy Imports Increased Most Significantly YOY

The Sep ’20 U.S. Share of Total Chinese Dairy Imports Increased Most Significantly YOY  Chinese Dairy Imports From the EU-28 up the Most Over the Past 12 Months

Chinese Dairy Imports From the EU-28 up the Most Over the Past 12 Months