India Economic Summit: Jayen Mehta Speaks on Amul’s Global Expansion and Triumph at Republic Media Network’s 2024 Event.

India Economic Summit: At the India Economic Summit (IES) 2024, in conversation with Republic Media Network’s Senior Executive Editor Abhishek Kapoor, the Managing Director of Gujarat Co-operative Milk Marketing Federation (Amul) Jayen Mehta, shared insights into the brand’s global growth trajectory. Mehta discussed Amul’s expansion plans, including its recent entry into the US market and a forthcoming launch in Spain, marking the brand’s foray into Europe.

Mehta said, “Amul is the largest food brand and the dairy brand of the world. Our brand stands right ahead in the world. We have processing plants in America as well as Europe. In the next 10 years, India will produce 1/3 of the world’s milk. We will be on the breakfast table across the world. This is just the beginning. We are handling just 3 crore liters of milk, whereas India produces 60 crore liters of milk. Our brand stands right ahead in the world. We have 107 dairy plants, 35 of which are in Gujarat.”

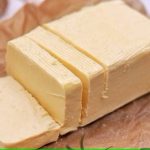

He also spoke about Amul’s new ventures, particularly in the United States, where the company recently launched fresh milk products. “We’ve been exporting to more than 50 countries for the last several decades, but now we thought this is a chance and opportunity for us to get into the fresh product business. And that’s how we launched fresh milk in the United States a few months back. It’s doing very well and it’s got into mainstream with a unique product, which is like our Amul Gold full cream milk, 6% milk fat, which nobody in the US ever imagined that you can have a milk like that. It’s doing very well.”

Mehta further elaborated on the European market, stating, “We realized that Europe is a market with a large number of Indian diaspora, and we need to find a way to enter that market. So, we have tied up with a local cooperative in Spain, and we’ll be launching our fresh milk range, followed by buttermilk, curds, and other fresh products. More importantly, the taste of India gets global.” He added, “We are able to address the Indian diaspora and eventually create a market for Indian milk around the world.”

Mehta also stated how the Amul Girl has become the mood of the nation. He said, “Whatever she says or she speaks is what is the mood of the nation. At times, she is sad or she is happy. In cheeky, humourous and a very light way she communicates with our consumers. The agency has full creative freedom. We don’t have editorial interference in branding or campaigning through Amul Girl.”

Addressing the unique appeal of Amul’s products, Mehta responded to a question about breaking into the American market, saying, “The taste comes in there, and the milk they are used to is cow milk, which is maximum 3% fat. People, under the fear of consuming more fat, go into skim milk, but the taste buds never go away. The Indian diaspora loves the creamy milk. There was a gap in the market. We found a very right partner in a cooperative there. And that’s how we decided to experiment with this idea. Fortunately, it worked very well because the entire marketing mix was in place.”

Mehta is optimistic about Amul’s future in the US, adding, “I’m very confident that in a couple of years, Amul will be the only pan-American milk brand.” On whether the famous “Amul doodh peeta hai” tagline would appear in the US, Mehta confirmed, “Of course, of course. That’s actually a validation of Amul doodh peeta hai, India. It’s a very logical extension. We’ll start soon in Europe also. So that’s how we are building up a network of facilities within and outside the country.”

Mehta also highlighted Amul’s significant global presence, noting, “This is the single largest consumer brand in terms of sheer number of packs sold globally, with a turnover of Rs 80,000 crore, which is 10 billion dollars. It’s the largest FMCG company in the world and ranked as the strongest food brand and dairy brand globally.”

He reflected on Amul’s journey, noting, “The journey of Amul, which started with just two villages and a few women, has made a big transformation, not only for the livelihood of such a large number of women, but as a country, all of us take pride that our brand stands right at the top in the world. This is what a model of a cooperative can do, and this is what is a game changer for the nation.”

Mehta concluded by emphasizing Amul’s impact on India’s economic growth, underscoring its significance as both a symbol of India’s cooperative movement and a global brand.

Mehta also highlighted Amul’s immense global presence, stating, “This is the single largest consumer brand in terms of sheer number of packs sold globally, with a turnover of Rs 80,000 crore, which is 10 billion dollars. It is the largest, not just food, but also the FMCG company in the world.”

The India Economic Summit, held at Republic’s headquarters—the largest news center in Asia—brings together policymakers and industry leaders to discuss India’s economic future. This year’s theme, “Viksit Bharat: Bullseye,” focuses on envisioning a $50 trillion economy by 2047.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇮🇳 eDairy News ÍNDIA: https://whatsapp.com/channel/0029VaPidCcGpLHImBQk6x1F