https://www.youtube.com/watch?v=Diwae23smNI

Though milk as farm commodity can’t be compared with food grains, the management of this perishable liquid through cooperatives may offer farmers and policy makers some insights. The milk cooperative model can be an apt example when the sector, backed by newly enacted farm laws, looks to offer options for small and marginal farmers, accounting for 86% of India’s farming community, through promoting an additional 10,000 farmer producers’ organisations (FPOs) over next five years.

“The FPOs may be a game-changer for farmers the way milk cooperatives in different states changed the dairy sector landscape over the years. The model may not only save crop farmers in crisis as we had seen for dairy farmers during Covid-19, but can also ensure economies of scale even in normal situation for getting better price of their produce,” said an official.

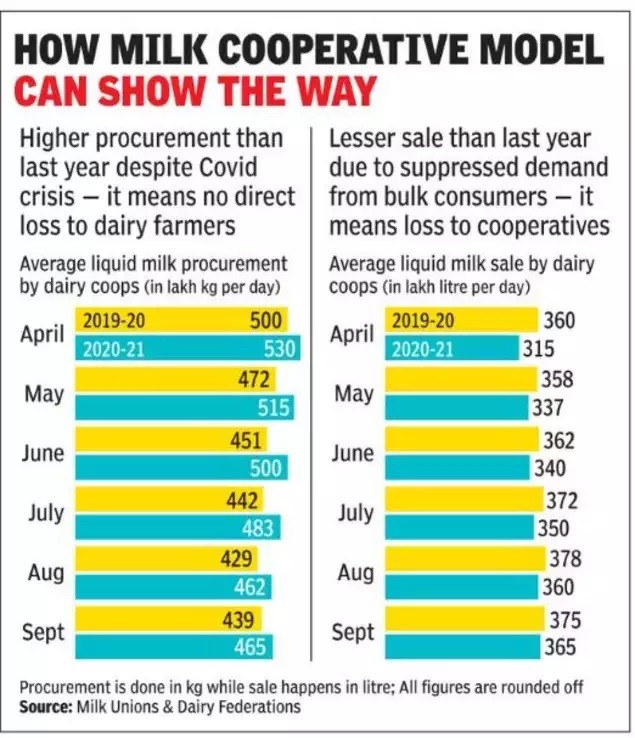

Data of first six months (April-September) of current and previous financial years show that dairy cooperatives did not stop procurement despite selling less during the six months in 2020 compared to the corresponding months last year. Ideally, the procurement of cooperatives and sale could have been higher. But, data from milk unions and dairy federations shows procurement remained higher even as sales dipped below the previous year due to Covid crisis. Dairy cooperatives could not sell due to massive drop in demand from bulk consumers — requiring conversion into long shelf life milk powder. This conversion, however, won’t give them immediate returns. Nevertheless, they managed to maintain supply chain for daily retail domestic consumers.

“If supply of milk and milk products were not interrupted during this period of crisis, we should thank the dairy cooperatives and other producer centric organisations who have been resilient enough to work tirelessly as Covid warriors during this emergency to minimise the disruptions in the dairy supply chain,” said Dilip Rath, chairman, National Dairy Development Board which promotes, finances and supports producer-owned and controlled organisations.

Rath said the Centre responded to the need of the dairy sector and announced an interest subvention scheme on working capital loans to address the liquidity problem. Most of the private players, including processors, had significantly reduced milk procurement as demand dipped due to closure of hotels, restaurant and catering (HORECA) segment, lack of purchasing power with consumers and aversion to the chilled milk beverages and ice creams during Covid-19. Though the economy is now getting progressively unlocked, the HORECA segment is expected to remain subdued as people will prefer in-home eating.

“We should take this crisis head-on and convert these into an opportunity to undertake structural reforms to bring about efficiencies, effectiveness and sustainability across the dairy value chain. On the consumer side, rather than waiting for consumer to reach to us, we will have to reach to consumers through doorstep delivery, use of e-commerce portal, innovations for nutritious and immunity boosting products, and building awareness about the quality of the packaged milk and milk products,” Rath said.