As commodity prices continue to reel the impacts of COVID-19 on demand and market prices, Coronavirus Food Assistance Payments (CFAP) continue to roll out.

??As of July 20 $6.2B out of a possible $16B in #CFAP #COVID relief funds have been paid to #agricultural #farmers w/ #cattle $2.7B #milk $1.3B #corn $1.1B #hogs $394M #soybeans $314M #cotton $156M #amonds $43M = 96% total pmts @FarmBureau pic.twitter.com/SR1tdcayyG

— John Newton (@New10_AgEcon) July 21, 2020

According to American Farm Bureau Federation, as of July 20, USDA had made $6.2 billion out of a possible $16B in CFAP payments. The largest chunk went to cattle producers, totaling $2.7 billion, followed by dairy at $1.3 billion in payments. The third largest sector to receive payments is corn farmers, receiving a total of $1.3 billion so far.

The projected $16 billion in CFAP may help cushion some of the projected losses in 2020 net farm income, but Pat Westhoff, an economist with University of Missouri’s Food and Agricultural Policy Research Institute (FAPRI) is now casting doubt. He says based on the current status of CFAP payments, he doesn’t think USDA will hit $16 billion.

“Whether that’s an issue with program design, or with people who are applying, I know frankly don’t know, but it is one that is definitely grabbing our attention,” Westhoff says. “If we were forced to have a new [net farm income] snapshot today, we would probably assume something less than $16 billion those payments being made.”

Currently, FAPRI’s projections released in May showed net farm income falling slightly in 2020. The lower net farm income projection was even with the $16 billion in CFAP payments.

“If you look at our own estimates for the month of May Based on conditions at that time, we were expecting that net farm income will be off a little bit this year, in spite of $16 billion in CFAP payments, and you’ll have significantly larger cuts in 2021,” Westhoff says. “For this year, if things played out the way we were projecting back a month or two ago, it’s a difficult situation, obviously, for a lot of producers in a lot of places, but the sector as a whole was not seeing perhaps as severe of a crisis as we once thought, given all the payments that are going out the door.”

Westhoff says he’s not ruling out more aid to be announced this year, as stimulus is currently being debated in Congress. He says it’s just a matter of whether any future aid will be prescribed by Congress or USDA.

Early Exclusive: Farmer Mac’s “The Feed”

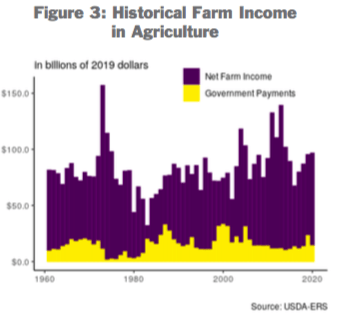

As portions of agriculture fight to be included in the next round of stimulus, current ag programs are helping soften the market losses spurred by COVID. An early exclusive of “The Feed” from Farmer Mac shows if government payments hit the amounts projected when the programs were released, the amount of government support that makes up farmers’ take home pay will be historically high this year.

In an early exclusive of Farmer Mac’s summer edition of The Feed, Jackson Takach, lead author and chief economist at Farmer Mac, told Farm Journal the average farm take home pay is $100 billion per year.

“We take home about $100 billion dollars once you paid for all your cash expenses and made some adjustments for some of the non-cash expenses. It’s about $100 billion, that’s a that’s a way to think of it,” he says.

This year, more than a third of farmers’ take-home pay will be from government programs, including CFAP, he adds.

“This year alone, CFAP is designed to deliver $16 billion, plus you had a little bit of MFP leftover so that’s another $4 billion,” he says. “We’re looking at right around $20 billion just in that one block of what you could consider sort ad hoc programs. That doesn’t even include crop insurance subsidies and other programs that are designed to offset lower prices. So, you’re talking about a 30 to 40% of take-home pay being delivered through government programs, and historically, that’s a very high number.”