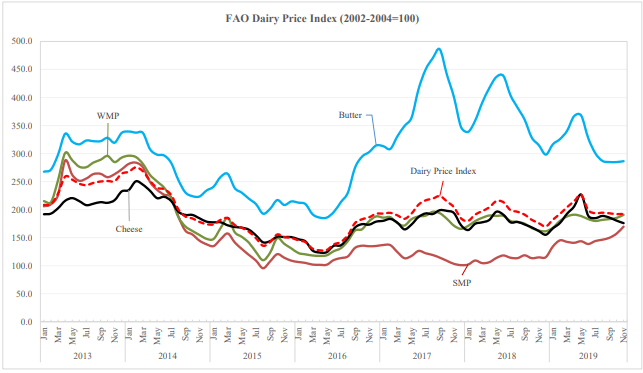

From January to May, the index rose by 24 percent, reflecting limited global export supplies while import demand was quite robust.

Supply tightness during the period stemmed from strong internal demand that reduced export supplies from Europe and seasonally low export supplies from Oceania. Supplies from Europe suffered a setback owing to unusually high temperatures that reduced milk production during the summer months.

Supplies also reduced from Oceania, especially Australia, due to dry weather that limited water availability and pasture quality. Since June, however, global dairy prices weakened because of increased export supplies and frail demand for some dairy products.

The weather in New Zealand was favourable for milk production in the 2019/20 season that began in June, contributing especially to cover a milk production decline in Australia.

Starting from about July, milk production also increased in the Americas, especially in the United States of America, Argentina and Chile, contributing to increased global dairy supplies.

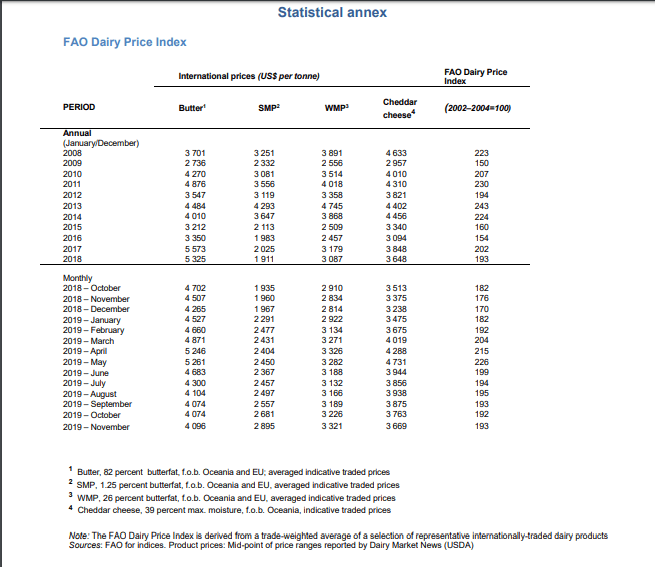

From January to November, the FAO index for skim milk powder (SMP) increased the most (+26.4 percent), followed by whole milk powder (WMP) (+13.6 percent) and cheese (+5.6 percent), but butter declined (-9.5 percent).

The index for SMP increased by 26.4 percent between January and November or 47 percent from the corresponding month last year, but remained 41 percent below the peak reached in April 2013. Global demand for SMP was quite robust throughout the year, except for when markets were somewhat inactive during the summer months in Europe.

From July onwards, SMP prices strengthened sharply because of limited export availabilities from Europe, reflecting seasonally low milk supplies, and in Oceania, production was active but competing demand for available milk supplies from other dairy products, especially WMP and cheese, constrained production from rising notably.

The index for WMP increased by 13.6 percent between January and November or 17.2 percent from the corresponding month last year, but remained 38 percent below the peak reached in April 2013. Except for some price weakness in some months in the first part of the year, WMP prices continued to increase, principally driven by strong import demand, especially from China, but also Algeria, the United Arab Emirates and Saudi Arabia.

WMP export supplies were relatively constrained in 2019 due to production declines and/or increased internal demand, including in the European Union, Australia and the United States of America. In this challenging environment, New Zealand – the world’s largest WMP exporter – provided some stability to WMP markets.

From September to November, WMP manufacturing in New Zealand increased, but milk production started to decline faster than most had anticipated, adding some uncertainty to the sustainability of export growth.

The index for cheese increased by 5.6 percent from January to November or 8.7 percent from the corresponding month last year, but remained nearly 30 percent below the peak reached in February 2014.

Global cheese prices increased in the first several months of this year, especially up to May, as export supplies remained subdued compared to import demand. Limited export supplies from New Zealand was a particularly important factor, while European supplies were also relatively limited.

Since June, however, global supplies increased, especially from New Zealand, coinciding with high seasonal production. This led global supplies to be slightly ahead of import demand, causing prices to weaken.

The index for butter declined by 9.5 percent from January to November, 41 percent below the peak reached in September 2017. Quotations for butter supplies from Europe declined almost throughout this year, a trend that began in May 2018. Butter prices in Europe stabilized somewhat in October and November, reflecting decent overall demand, notwithstanding ample export availabilities.

By contrast, butter prices in Oceania increased in the first few months, especially up to May, reflecting seasonally low supplies, but since then, they declined because of increased export availabilities from Oceania as well as other major producers including the United States of America.

Measures-related to production

The European Union: SMP intervention stock buying-in-price

In September 2018, the European Union fixed the SMP buying-in price to the intervention stock at zero for the period from 1 March to 30 September 2019. Since the establishment of the intervention stock, the European Commission had the option of buying 109 000 tonnes of SMP at EUR 1 698 (USD 1 981) per tonne during the buying-in period. In addition to fixing the buying-in price at zero, the European Commission began auctioning off its intervention stocks. By July 2019, the Commission had auctioned off all stocks and refrained from adding SMP into the stock, effectively ending a mechanism introduced to stabilize the market and support to farmers. At its height in September 2016, the SMP stock reached 430 000 tonnes.

Indonesia: regulation on milk supply and distribution

In July 2018, Indonesia revised its regulation related to milk supply and distribution, eliminating the requirement introduced in July 2017 directing importers of milk and milk products to have partnership arrangements with local producers to purchase milk, invest in local production or promote the consumption of local milk. However, Indonesia continued to encourage partnerships as an approach to reduce the current gap between local production and milk imports. From 2008 to 2019, the gap rose from less than half a million tonnes to nearly 1.5 million tonnes.

New Zealand: funding for sustainable dairying

In September 2018, New Zealand allocated 7 million NZD (approximately USD 5 million) for genetic research. In June 2019, New Zealand provided additional funding of NZD 25.7 million (approximately USD 17 million) for sustainable innovations in the dairy sector. The second programme aims to generate long-term economic, environmental and animal health benefits; improve worldwide reputation for New Zealand dairy products; and increase milk yield to sustain production increases. Increasing productivity is vital for New Zealand, especially in the context that the country’s national dairy herd has reached the maximum sustainable capacity of 5 million dairy cattle, although dairy farms are getting more specialized and larger.

The United States of America: farm subsidies

On 24 July 2018, the United States of America announced a plan to provide subsidies worth USD 12 billion for farmers, aiming to “stabilize, support and protect farm income and prices” and to contain the impact from the retaliatory tariffs imposed by trading partners in response to US tariffs on steel and aluminium imports. The programme offered USD 250 000 per eligible producer of specified commodities, including dairy and livestock during the period from 29 July to 6 December 2019. In addition, the government offered compensation through the Disaster Relief Act 2019 and activated food purchasing and distribution to purchase surplus of affected commodities and a trade promotion programme to develop new export markets under The Commodity Credit Cooperation (CCC) is implementing the programme, while the Foreign Agricultural Services is responsible for developing new export markets.

Japan: food standards

Japan added standards required for production and sale of liquid infant formula to its Food Sanitation Act, starting from August 2018. This emerged due to lobbying by the Tokyo metropolitan government and the domestic dairy industry that having infant liquid milk formula in its stocks could help during emergencies. Same way, a consideration was given to a petition that indicated that access to infant liquid milk formula provides greater flexibility for mothers to re-enter the labour market after childbirth. The new rule has led some local governments to build emergency stocks of infant liquid milk formula.

Mexico: new agricultural support programme

In January 2019, Mexico introduced a new agricultural support programme, replacing the Proagro Productivo, and allocated nine billion pesos (approximately USD 474 million) for 2019. The new programme aims to improve the living conditions of some 2.8 million small-scale producers with less than five hectares of land by providing guaranteed prices for selected agricultural commodities; offered assistance to farmers and companies in the livestock sector for acquiring equipment or infrastructure; and improving livestock management (reproduction, maintenance or rehabilitation of grazing lands).

China: new agricultural policy

On 19 February 2019, China unveiled its annual government policy document, outlining changes to agricultural policy framework. Following the farm consolidation policy that led to significant changes in production and trade in milk and milk commodities, the new policy emphasized the need to focus on upgrading and renovating small and medium-sized dairy farms. In addition, the government proposed to provide support for identifying agricultural technology and financing rural economic activities including the dairy sector.

Tunisia: revisions to food safety law

In February 2019, Tunisia approved a law on food and feed safety. It proposed to create a national authority for food safety and a national agency for risk assessment; and provided legal ground for repealing and replacing some aspects of Tunisia’s law on animal husbandry. The new law compels exporters to comply with food safety standards, including food content requirements, labelling and marketing. Tunisia’s market for cheese and food preparations is about USD 2 billion a year.

New Zealand: efforts to eradicate mycoplasma bovis

In March 2019, New Zealand launched a national plan to eradicate mycoplasma bovis, which aims to eradicate the bacterium from the country’s cattle herd and strengthen the national biosecurity system. By September 2019, New Zealand cleared 171 properties as free from the bacterium, while leaving 20 under quarantine. The Ministry of Primary Industries is leading the programme in collaboration with stakeholders.

Japan: agricultural support

Japan allocated more funding for the Agriculture and Agricultural Villages Improvement Programme in the 2019/20 fiscal year. The programme aims to consolidate and enlarge farmland and improve agricultural waterways and reservoirs; and promote smart agriculture as a means to address farm labour shortages, a longstanding issue that beset the agricultural sector. The Agricultural Villages Improvement Programme is a core public support programme that aims to consolidate farmlands, improve agricultural waterways and reservoirs. Japan also uses market price support (MPS), based on output and variable input use, mainly directed at rice, pig meat and milk production.

Measures related to trade

Bilateral / multilateral trade negotiations

The United States of America–China trade negotiations

The United States of America and China have been negotiating to find a solution to the trade dispute between the two countries that began when the United States of America levied tariffs on all imported washing machines and solar panels in January 2018. Despite the negotiations, both countries continue to maintain tariffs and retaliatory tariffs on imports of both countries. The United States of America has proposed to levy taxes for all imports from China, estimated at USD 570 billion and China has announced plans to levy import taxes on imports from the United States of America worth USD 170 billion. From January to September, dairy product exports from the United States of America to China (Mainland) declined, with whey powder falling by 74 percent, cheese by 40 percent, SMP by 82 percent and WMP 90 percent.

The United States of America–Mexico trade negotiations

On 5 June 2018, Mexico levied a 15 percent retaliatory tariff on US agricultural products due to US tariffs on steel and aluminium. On 17 May 2019, the United States of America announced the removal of tariffs on steel and aluminium, and in response, Mexico lifted retaliatory tariffs, effective 10 June 2019. However, on 30 May 2019, the United States of America announced the imposition of five percent tariffs on all imports from Mexico with the effective date from 10 June 2019. In a subsequent joint communique, the imposition of the tariff was postponed indefinitely, but the announcement led to short-term market uncertainty, including a sharp fall in peso value. Mexico imported over 252 000 tonnes of SMP between January and September 2019, valued at over USD 584 million.

The United States of America–Canada trade negotiations

On 1 July 2018, Canada levied a 10 percent retaliatory tariff on imports from the United States of America, including selected agricultural products, in retaliation of tariff on steel and aluminium by the United States of America. On 17 May 2019, the United States of America announced the removal of tariffs on steel and aluminium, and in response, Canada lifted the retaliatory tariffs against the United States of America.

The United States of America–Mexico–Canada Agreement

On 30 November 2018, the United States of America, Mexico and Canada signed a trade agreement called the United States-Mexico-Canada agreement (USMCA), replacing the North American Free Trade Agreement (NAFTA). According to the report published by the United States International Trade Commission (USITC) on 18 April 2019, USMCA would elevate United States GDP by 68 billion USD (0.35 percent) and generate 176 000 employment opportunities (0.12 percent); and increase exports to Canada by USD 19.1 billion (5.9 percent) and to Mexico by USD 14.2 billion (6.7 percent). The agreement is expected to offer market access for dairy products from the United Stats of America through new Canadian tariff rate quotas (TRQs), including fluid milk, cream, butter, SMP and cheese. This new Canadian dairy TRQ is expected to generate significant benefits for the United States of America, but trade with Mexico is likely to have little impact, as the agreement does not have provisions for changing each other’s market access opportunities. The agreement includes provisions for levying export surcharges on total Canadian exports over certain volume for all countries and for protecting GIs and intellectual property rights.

The United States of America–the European Union trade negotiations

On 8 April 2019, the United States Trade Representative (USTR) announced a process for levying tariffs against the European Union countries under the Section 301 of the Trade Act of 1974. In retaliation, the European Commission on 18 April 2019 indicated to levy tariffs against imports from the United States of America, worth Euro 20 billion, citing its own case in the WTO against subsidies for the Boeing Company. On 1 July 2019, the United States of America released a list of additional items that could be subject to tariffs from the European Union. In the meantime, the WTO ruled that subsidies to the Airbus Industry provided by the European Union have violated WTO rules governing subsidies. On that basis, the United States of America in October 2019 announced tariffs, ranging from 10 to 25 percent on imports, worth 7.5 billion USD from the European Union. The dairy sector is particularly vulnerable, as both sides have dairy products in their lists for retaliatory tariffs.

Trade agreements

The European Union–Japan trade agreement

In July 2018, the European Union and Japan signed an economic partnership agreement (EPA), which entered into force in February 2019, aiming to build closer economic partnership. The EPA proposed to eliminate Japanese custom duties on European Union cheese exports to Japan by staggered reductions starting from the current rate of 30 percent. Moreover, the agreement aims to establish a duty-free quota for some cheese varieties such as mozzarella, and protect more than 200 European agricultural products in Japan, mostly with GIs. Japan notified the WTO in August 2018 of its intention to amend one of its legislative acts called the Act on the Protection of the Names of Specific Agricultural, Forestry and Fishery Products and Foodstuffs to ensure reciprocal protection granted under the bilateral agreement.

The European Union–Singapore trade agreement

In October 2018, the European Union and Singapore signed a free trade agreement, aimed at eliminating customs duties within five years for qualifying products from Singapore. Among the nine main parts of the agreement, labelling and safety testing, customs procedures, intellectual property and trade in goods will have implications for the dairy sector.

The Comprehensive and Progressive Agreement for Trans–Pacific Partnership (CPTPP) On 30 December 2018, Australia, Canada, Japan, Mexico, New Zealand, Singapore and Viet Nam signed the CPTPP, granting its members TRQs for livestock products. A second round of tariff cuts came into effect on April 1, 2019 for both CPTPP. Under the agreement, each member country has agreed to reduce tariffs and implement TRQs on staggered basis, covering a range of goods, including dairy products.

Indonesia–Australia Comprehensive Economic Partnership (IA-CEPA)

In March 2019, Indonesia and Australia officially signed the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA). The agreement aims to reduce tariffs on a range of products and address issues related to non-tariff barriers and import licensing, especially the issuance of import permits, which was under negotiation for a long time. The two countries agreed to establish a committee on trade in goods within 360 days, which will address issues related to sanitary and phytosanitary matters, technical barriers to trade and trade facilitation. The agreement has provisions for the elimination of tariffs on dairy products.

The European Union–MERCOSUR trade agreement

In June 2019, the European Union and the Southern Common Market (MERCOSUR), comprising Argentina, Brazil, Paraguay and Uruguay, reached an agreement on trade in June 2019. The agreement aims to strengthen trade, guarantee GIs originated in the European Union and remove majority of tariffs on dairy exports to Mercosur. In return, MERCOSUR countries will receive greater access for meat products in the European Union.

The European Union–Viet Nam trade agreement

In June 2019, the European Union and Viet Nam signed a trade agreement and an investment agreement, effectively consolidating the European Union–Vietnam Framework Agreement on Partnership and Cooperation (PCA) that entered into force in October 2016. Once entered into force, the agreement will offer the European Union duty free access for its dairy products (currently up to 20 percent tariff) into Vietnam over a five-year period The agreement expects to support jobs and economic growth on both sides; reduce regulatory barriers; ensure protection of geographical indications; and open up services and public procurement markets. Vietnam receives trade preferences of the European Union under its preferential tariff system, known as the Generalised System of Preferences (GSP).

Tariff rate quotas

A significant proportion of global trade comes under TRQs, as many countries / regions use them for controlling markets. Some changes to dairy TRQs made in 2019 are summarised below.

In January 2019, the European Parliament, apportioned the TRQs for agricultural products, including dairy products, between the rest of the European Union countries and the United Kingdom of Great Britain and Northern Ireland, in anticipation of Brexit.

In April 2019, Japan announced dairy TRQ volumes that will be open during the Japanese fiscal year 2019 (April-March). Following the decision to permit the domestic sale and manufacture of liquid infant milk recently, Japan also included whey powder imports, primarily for producing liquid infant milk, within the exiting TRQ of 25 000 metric tonnes from April 2019. Under the existing rules, dairy imports outside of the TRQ are subject to a tariff of 29.8 percent plus 425 yen per kilogram. In addition, Japan established additional TRQs for whey (which include whey for infant formula) for member countries of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Japan-EU Economic Partnership Agreement (EPA). Under CPTPP, Japan created a country specific TRQ for New Zealand starting at 1 300 MT and growing to 1 700 MT in 11 years, but whey powder for powdered infant formula is duty free under this TRQ. For the European Union, Japan established a whey TRQ starting at 6 200 MT and growing to 9 400 MT in 11 years. Meanwhile, Japan lowered its planned SMP import volumes for 2019 fiscal year to 16 000 tonnes from 20 000 tonnes.

In August 2019, the Russian Federation published TRQs for 2019 for the countries in the Eurasian Economic Commission. TRQs remained unchanged from the 2018 levels.

January 2019, the United States of America issued its Dairy Import License Circular for 2019, specifying TRQs allocated for dairy products and countries, under both a first-come first-served and Free Trade Agreements basis. In June 2019, the United States of America ended duty-free access for about 5.7 billion USD worth of Indian exports under the European Union GSP.

Sanitary and phytosanitary requirements

In December 2018, India extended the country’s ban on imports of milk and food preparations with milk or milk solids as an ingredient from China until laboratories are upgraded at ports for testing the presence of toxic chemical melamine. The ban was first introduced in 2008 due to food safety concerns.

In March 2019, South Africa restored exports of dairy products, which were banned earlier due to an outbreak of Foot-and-Mouth-Disease in January.

In April 2019, Belarus signed a protocol on quarantine and health requirements for dairy fodder products with China, authorizing three Belarusian dairy companies to sell dairy products in China.

Licensing arrangements

A number of countries issued dairy import licenses, paying the way for increased trade in the last one year.

In May 2018, Ukraine announced that Bosnia and Herzegovina have accepted Ukraine’s veterinary certificate, effectively providing market access there.

In July 2018, Turkey reopened market for US dairy products, ending a ban lasting nearly three years, after reaching an agreement for a new certificate.

In June 2018, Ghana confirmed the acceptance of a Veterinary Health Certificate for exports of cattle from the United States of America, proposed by the US Department of Agriculture.

In April 2019, China entered into agreement with Slovakia for supplying dairy products to its market. China also signed a similar agreement with Turkey in September 2019, and with Serbia in September 2019.

In September 2019, Brazil announced the opening of the Egyptian market for its dairy products, as Egypt accepted the International Health Certificate (IHC), the primary requirement for exporting dairy products to the country. Egypt suspended Brazilian dairy imports in 2015. Several countries revoked or restricted their markets for dairy imports during the review period.

In June 2018, the Russian Federation announced an import ban on dairy products from Belarus in bulk form, including pasteurized milk and cream, sterilized and ultra-pasteurized milk, milk and cream, whey and concentrate of whey and milk protein. Similarly, in November 2018, the Russian Federation imposed an import ban on a leading producer in Turkey. In June 2019, the Russian Federation extended until the end of 2020 the existing ban on agricultural products, including dairy, from the countries that applied economic sanctions against the Russian Federation.

In December 2018, Ukraine extended restrictions on imports of products, including dairy products, from the Russian Federation until 31 December 2019.

In January 2019, Zimbabwe suspended import duty on selected dairy products, including powdered milk raw materials.

In June 2019, Indonesia announced plans to levy tariffs ranging from 20 to 25 percent, up from the current level of 5 percent, against dairy imports from the European Union in retaliation against the levy of 8 to 18 percent imposed on biodiesel from Indonesia.

In September 2019, Uruguay announced the signing of an agreement with China for exporting 4 000 tonnes of milk powder from a major dairy company.

Import procedures

Several countries changed import procedures, inspections procedures and consumer finance.

In August 2018, China agreed with the United Kingdom of Great Britain and Northern Ireland to import dairy products made with milk from third countries.

In December 2018, Tunisia repealed its ban on import financing for selected imported consumer goods first introduced in October 2017 to tackle the balance of payments difficulties. The ban in 2017 reduced imports of dairy products. For example, cheese imports declined in 2018 y-o-y from the European Union by 9 percent, New Zealand by 42 percent and the United States of America by 92 percent. The removal of import financing may increase imports in 2019.

In October 2018, Viet Nam published a renewed Harmonized System (HS) of codes for imports and exports subject to specialized inspection and pre-customs clearance. This renewal affects HS codes of terrestrial animals and products thereof and animal feed and feed ingredients. The new inspection scheme came into operation on 1 January 2019.

FAO. 2019. Global Dairy Market: Price and policy update, December, 2019. Rome.