The United States has emerged as a dominant player in global dairy and grain exports, and any shift in Indian tariff policies has far-reaching implications for bilateral trade.

In 2024, U.S. cheese exports reached approximately 508,808 tonnes, marking a record year for the U.S. dairy sector. Despite this impressive export capacity, India’s cheese imports remain minuscule. India imported only around US$13.5 million worth of cheese and curd in 2023, implying that U.S. shipments to India are marginal relative to global U.S. volumes. The opening of India’s market to premium cheese categories would therefore create a niche but promising opportunity for U.S. suppliers, without severely disrupting India’s domestic dairy ecosystem that primarily focuses on mass-market liquid milk.

Beyond cheese, whey and whey protein concentrates (WPC) represent a major area of interest. The U.S. is a global powerhouse in whey production, with 2024 whey/whey-product exports valued between US$700–850 million, depending on the definition of HS codes used. Tridge reports U.S. whey protein powder exports at US$781 million, and the country accounts for nearly 47% of the global high-protein whey export market volume. India does import whey and WPC from the U.S., with hundreds of shipments annually, but total volumes remain modest relative to global flows.

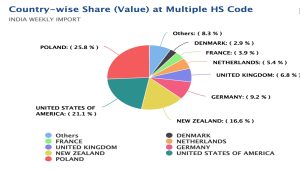

India already imports significant volumes of whey protein concentrates (WPC) from the United States. Between February 2021 and September 2025, the U.S. consistently ranked as the second-largest exporter of WPC to India, holding roughly 21% share of India’s total whey imports during this period. If India were to lower tariffs or simplify market access for whey proteins, the immediate beneficiaries would be U.S. whey producers as well as Indian food processors that depend on whey for manufacturing nutrition products, bakery items, and beverages.

Therefore, the narrative that “no dairy products are being imported into India because of the use of animal-derived feed in the American dairy ecosystem” seems misleading. The reality is that commercial whey and WPC shipments from the U.S. are already entering India in substantial quantities, and the trade relationship in this category is well established. This raises a valid question on whether further lowering of tariffs or easing market access is necessary, especially if it risks undermining domestic dairy processors and farmers.

Maize is another crucial element in this analysis. The U.S. exported approximately 2.75 billion bushels of corn in the 2024/25 marketing year, equivalent to nearly 69.8 million metric tonnes — a massive global export flow. By contrast, India imported just 0.9–1.0 million tonnes of maize in 2024–25, primarily from Myanmar and Ukraine. This shift from being a net exporter to a net importer was driven by growing ethanol demand. However, U.S. corn currently plays almost no role in Indian imports due to India’s restrictions on genetically modified (GM) maize. If India were to relax these restrictions, the U.S. could potentially secure a significant share of the Indian market. Still, political and regulatory resistance to GM crops in India remains high, limiting short-term prospects for U.S. maize exporters.

The casein trade presents a different picture altogether. Globally, New Zealand, Ireland, and the Netherlands dominate casein exports, with New Zealand alone exporting approximately US$1.06 billion worth of casein in 2023.

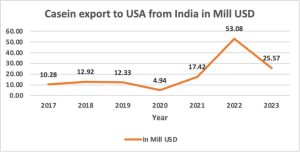

The U.S. is among the world’s largest importers of casein, yet India’s share in supplying this demand has been steadily shrinking post-2023. Historical trade data show that between 2017 and 2023, India’s casein exports to the U.S. ranged from US$10 million to US$53 million annually. However, from April 2024 to August 2025, India’s shipments to the U.S. dropped dramatically, accounting for barely 3% of India’s total casein exports.

This sharp decline underscores a critical point: any relaxation of tariffs on casein would disproportionately benefit exporters from Oceania and Europe — New Zealand, Ireland, and the Netherlands — who dominate global casein trade, rather than strengthening India’s position. In other words, tariff softening in this segment would do little to support Indian producers but would hand a competitive advantage to global rivals at the cost of domestic industry resilience.

Winners and Strategic Implications

If India softens tariffs on premium cheese, U.S. and European exporters would be the primary winners. Given that India’s cheese market is still small and limited to an urban, premium consumer base, this opening would not significantly harm domestic milk producers but could accelerate culinary diversification.

Similarly, a reduction in whey tariffs would directly benefit U.S. whey producers, who already dominate global trade, and would support India’s growing health and wellness sector by lowering input costs for protein supplements and nutrition products.

Maize imports present a more conditional opportunity. U.S. corn exporters could capture market share only if India allows GM maize and resolves phytosanitary issues. Until then, imports will likely remain dominated by Myanmar and Ukraine.

For casein, tariff relaxation would primarily help New Zealand and EU exporters, since India does not play a significant role in casein exports to the U.S.

In conclusion, any tariff softening from the Indian side, particularly on cheese, whey, maize, or casein, without securing a reciprocal benefit from the U.S. across a wider range of product categories, risks being a one-sided concession. India must ensure that its dairy and agri-ecosystem remains competitive and protected. Unless a comprehensive deal is negotiated that enables Indian companies to regain tariff parity and expand their exports to the U.S., such unilateral relaxation will undermine domestic value chains and render the entire exercise counterproductive.

Source : Blog by Kuldeep Sharma Chief editor Dairynews7x7 Sep 17th 2025

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇮🇳 eDairy News ÍNDIA: https://whatsapp.com/channel/0029VaPidCcGpLHImBQk6x1F