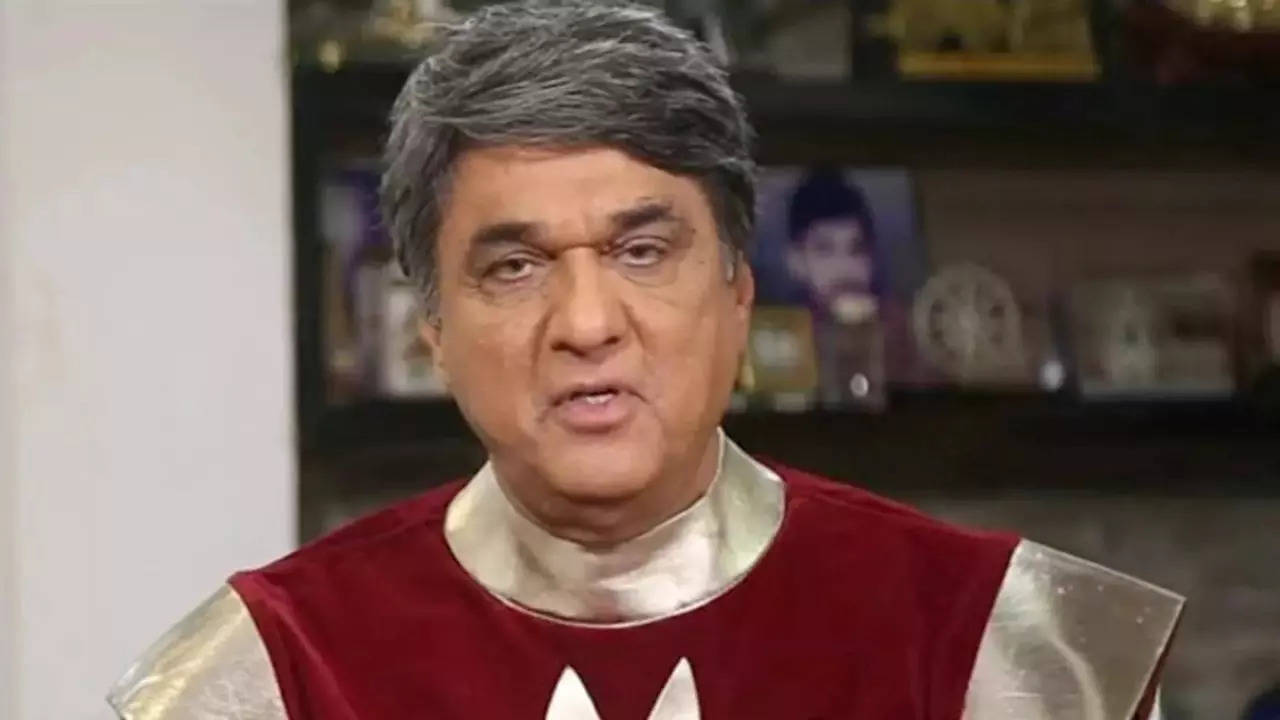

Mukesh Khanna, who shot to fame with the show, Shaktimaan, revealed that kids started drinking milk because of his character. Read full story to know more.

Actor Mukesh Khanna, who gained major stardom playing Shaktimaan in 1990s, said that the character was also a teacher and had even inspired children to have their milk. In a conversation with IANS during the launch of his song, Mukesh said: “I would like to tell you that Shaktimaan has two forms. One is an action hero, but Shaktimaan is not just an action hero. Shaktimaan is not just a superhero, he has also become a super teacher.”

He recalled: “I felt that in 1997, a lady came up to me and said, Mukesh ji, I am very thankful to you. I said, sister, what is the matter? She said, ‘I am very thankful to you’.

She said, ‘My child started drinking milk because of you. He didn’t drink milk. He didn’t drink milk when he was beaten. Now he has milk three times. ‘Shaktimaan said that if you drink milk, you will become powerful’.”

The actor added: “That made me realise the importance of Shaktimaan’s teaching.

We started talking about small topics. More than 200 messages as Shaktimaan. So, Shaktimaan is coming. You people have been asking for 2-3 years. When will he come? Who will come? Where will he come from? Will he come or not? Everyone is lying. Everyone is telling the truth.”

He said that he brought an angle of Shaktimaan being a super teacher.

“Which perhaps Shaktimaan will not be able to become in the future. I believe that my chemistry will not be the chemistry of Shaktimaan in the future. So, I have recorded a song. Through which I want to tell the children what is the name of the revolutionaries of our country.”

Shaktimaan was created by Mukesh that aired on DD National from September 1997 to March 2005. The actor played the role of Shaktimaan and his alter ego Pandit Gangadhar Vidhyadhar Mayadhar Omkarnath Shastri, a photographer for the newspaper Aaj Ki Aawaz.

Shaktimaan was depicted as a human who has attained superhuman powers through meditation and five elements of nature: Space, Earth, Air, Fire, Water. Kitu Gidwani, who was later replaced by Vaishnavi Mahant, played the role of Geeta Vishwas, a reporter who loves Shaktimaan. Surendra Pal played the role of Tamraj Kilvish.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇮🇳 eDairy News ÍNDIA: https://whatsapp.com/channel/0029VaPidCcGpLHImBQk6x1F