So-called “nontraditional lenders” operate outside the typical local branch and loan officer model. Table 1 summarizes the three major types of nontraditional lenders.

Table 1: Nontraditional lender types

| Type of nontraditional lender | Examples |

| High-volume, branchless lenders | Metlife Rabo Agrifinance |

| Vendor financing | Nutrien Financial John Deere Financial |

| Collateral-based lenders | AgriFinancial AgAmerica Conterra |

To better understand the role of nontraditional lending in the Wisconsin dairy industry, the University of Wisconsin–Madison conducted an online survey of dairy farmers in the spring of 2021. This fact sheet summarizes the main findings of that survey.[1]

Prevalence of nontraditional borrowing

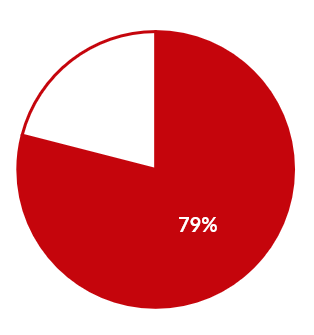

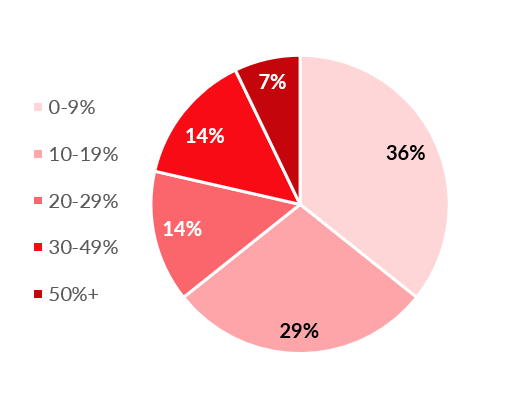

Sixteen Wisconsin dairy farmers completed the survey, with herd sizes ranging from less than a dozen to several thousand cows. Among the respondents, nearly 80 percent reported they had borrowed from at least one nontraditional lender in the preceding three-year period (Figure 1). However, credit from nontraditional lenders accounted for less than 20 percent of total borrowing for over half (65%) of survey respondents (Figure 2).[2]

Figure 1: Proportion of surveyed WI dairy farmers borrowing from a nontraditional lender

Figure 2: Proportion of operation’s credit coming from nontraditional lenders

Among the twelve farmers who reported borrowing from a nontraditional lender, ten of them received credit from the financial arm of a vendor (e.g., John Deere Financial). This was by far the most common source of nontraditional credit, surpassing branchless lenders (two survey respondents), collateral-based lenders (one survey respondent) and other nontraditional sources of credit (one survey respondent).

The prevalence of vendor financing matches how farmers reported using their nontraditional credit. Among farmers who borrowed from a nontraditional lender, six financed equipment loans, two financed operating loans, and three received “effective credit” through outstanding accounts receivable with vendors. These results suggest vendors are increasingly providing “in-house” financing for equipment and machinery purchases rather than relying on outside traditional lenders for loans.

Farmer perceptions of nontraditional lenders

Not a single surveyed farmer reported that they prefer nontraditional lenders over traditional lenders. Furthermore, over 60 percent of respondents said it is important for them to work with a specific person when borrowing money. However, most dairy farmers thought that nontraditional lenders provide different services than traditional lenders, and many believed nontraditional lenders to be more flexible.

When asked to explain their motivations for borrowing from nontraditional lenders, many farmers reported the competitive interest rates offered by nontraditional lenders (Table 2).

Table 2: Motivations for borrowing from nontraditional lenders (selected responses)

| “I use non traditional lending on some machinery purchases – those rates are normally lower than what my bank offers and also the dealership has it all done when I pick up the piece of equipment – it is like a one stop shop” |

| “Low or zero percent interest rate deals” |

| “Usually seed because of promotions from seed companies, like lower or no interest for certain time periods.” |

| “It was zero interest but it was due in a year” |

Implications for Wisconsin dairy farmers

Nontraditional credit is used by Wisconsin dairy farmers as a potential strategy to capitalize on opportunities and address challenges resulting from market volatility and a changing industry. Notwithstanding a small sample size, survey responses reflect the reasons farmers utilize alternative sources (e.g., high-volume lenders, input suppliers, and/or collateral-based lenders) for their borrowing needs rather than traditional agricultural lenders. Survey responses also highlight the potential educational needs of farmers for informed use of such financial resources.

Increased competition between lenders and the opportunity to restructure financing can create value for farmers and their operations. However, these forces can also complicate risk management decisions. Producers and policymakers alike stand to benefit from a solid understanding of the increasingly important role of nontraditional lending in modern agriculture. Increased oversight or regulation may be appropriate to ensure lending practices protect and support entrepreneurs, food security, and equal opportunity for all.

Implications for agricultural lenders

The recent rise of nontraditional lenders increases competition for traditional lenders. Nontraditional lenders have the comparative advantage of lower interest rates and less strict credit standards. After all, the primary motivation for many nontraditional lenders is machinery sales. It can be hard for a producer to pass up a lower interest rate. For example, a 3% lower rate on a $200,000 machinery purchase is worth $6,000 to the borrower.

Traditional lenders must compete on the value they add as a full-service financial “partner/consultant.” This may include financial analysis, evaluating and restructuring optimal debt structure and repayment terms, planning the financing of long-term goals, addressing current liquidity problems, and saying “no,” which in some cases may be the best value that can be given.

Further, traditional lenders may also need to add value by helping the farm incorporate a borrowing mix that includes some nontraditional credit rather than pushing an all-or-nothing approach. The rise of nontraditional lenders can make the traditional lending business more difficult, but competition tends to do that.

[1] Additional detail can be found in: Stevens, A. W. (2021). Nontraditional Credit in the Wisconsin Dairy Industry. Agricultural Finance Review.Results in Figures 1 and 2 are based on data from fourteen survey respondents who answered the relevant question about nontraditional credit use.

[2] Results in Figures 1 and 2 are based on data from fourteen survey respondents who answered the relevant question about nontraditional credit use.